By the EnergyProMag.com Editorial Team

The instability of energy costs, particularly pronounced in 2024 and continuing into 2025, presents a major challenge for the food and beverage industry. As a cornerstone of the economy and one of the most energy-intensive sectors, food manufacturing is directly impacted by market volatility. From the cold chain and cooking processes to transformation and logistics, the energy bill weighs heavily on production costs, directly threatening margins and increasing inflationary pressure. In this context, a robust energy strategy is no longer an option but a necessity to ensure the sustainability and competitiveness of businesses. This article provides concrete action levers and expert advice to control your costs, secure your energy contracts, and turn this challenge into a real strategic asset, with the potential help of a specialized energy broker.

Table of Contents

Why the Food Industry Is Most Exposed to Energy Price Hikes

The food and beverage (F&B) industry is at a crossroads. Its heavy dependence on electricity and gas, combined with often inadequate contract models, makes it particularly vulnerable to energy price fluctuations. Understanding these risk factors is the first step in building an effective resilience strategy.

Processes Heavily Reliant on Electricity and Gas

The transformation of raw agricultural materials into finished food products is an inherently energy-intensive process. Every step, from storage to shipping, requires a constant and significant energy supply. The most critical areas include:

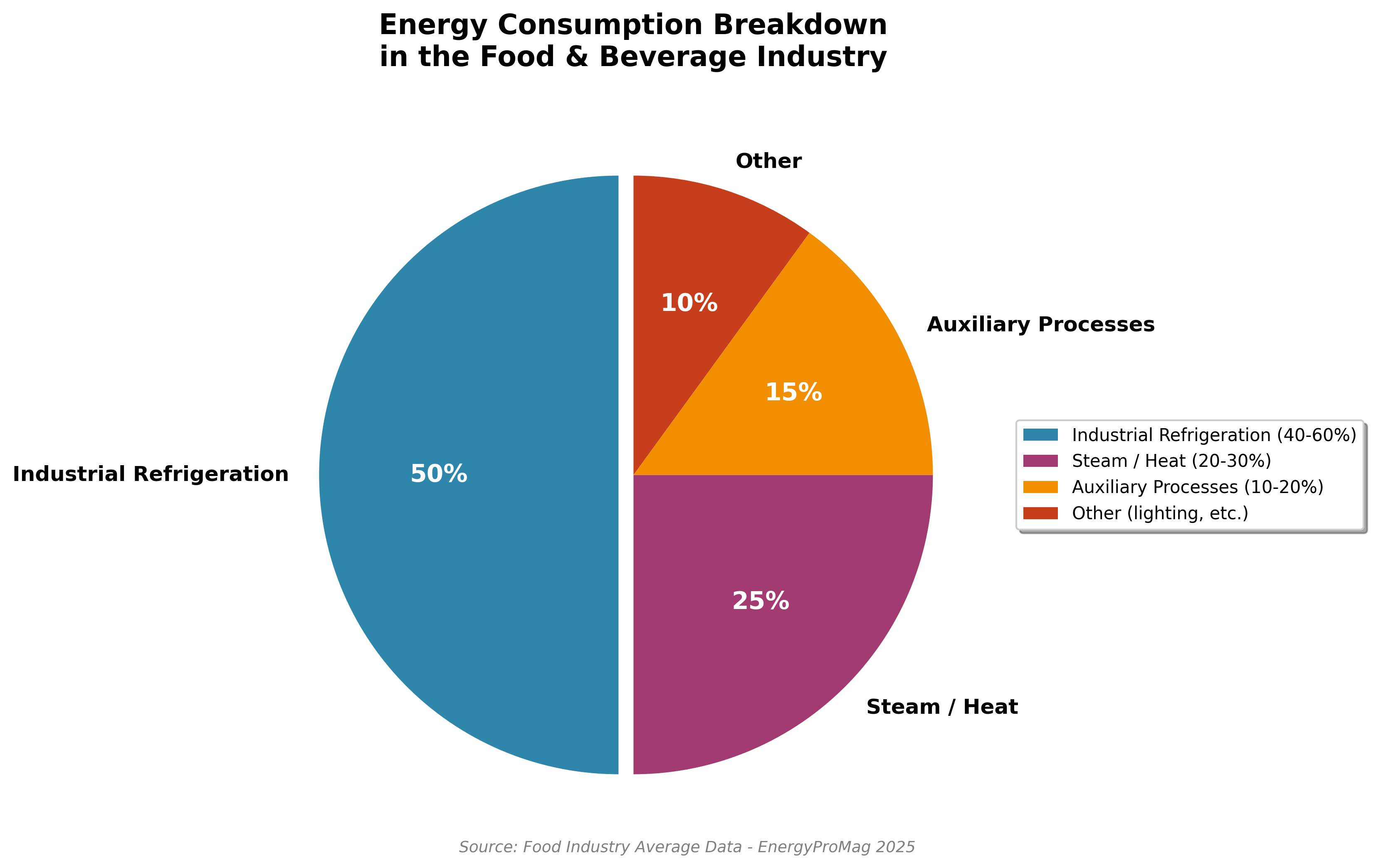

- Cold Production: Refrigeration, freezing, and maintaining the cold chain often account for 40% to 60% of a site’s total electricity consumption.

- Cooking and Pasteurization: These thermal processes, essential for food safety and quality, are major consumers of gas or electricity.

- Other Utilities: Washing, ventilation, lighting in production areas, and compressed air for machinery also contribute substantially to the energy bill. On average, energy can represent 6% to 12% of the total production cost of a product, a ratio that can quickly climb during a crisis.

Typical breakdown of energy consumption in a food processing plant.

Contracts Often Tied to Variable Prices

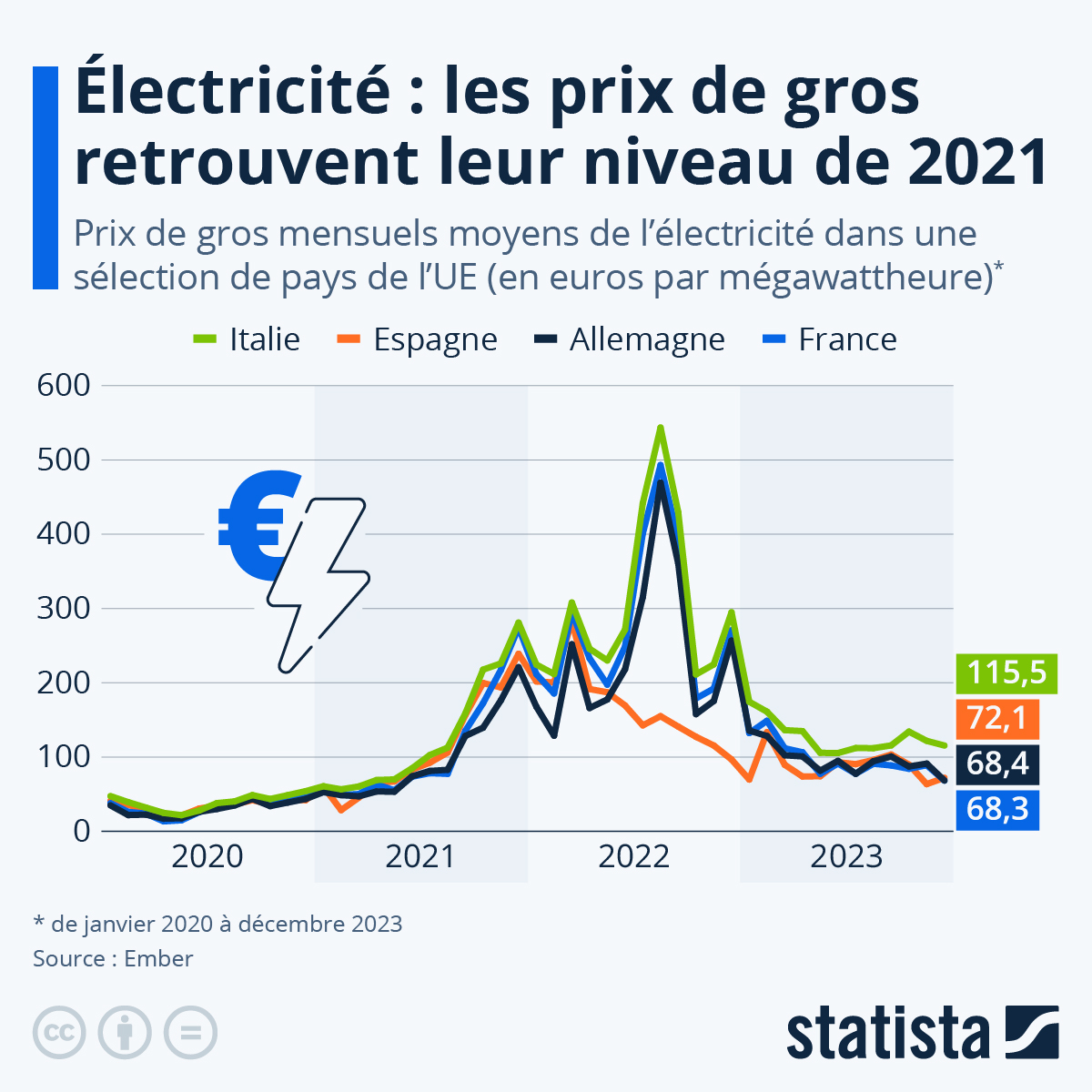

Historically, many companies in the sector opted for energy contracts indexed to wholesale market prices. While this approach may have offered advantages in the past, it now exposes manufacturers to significant risk. A sharp price fluctuation, like those seen between 2022 and 2024, almost instantly translates into a direct loss of margin, which is difficult to pass on to retail prices in a context of tense negotiations with large distributors.

Increased Dependence on Wholesale Energy Markets

The dynamics of energy prices are directly linked to European spot markets, such as EPEX Spot for electricity, where prices vary daily, even hourly. Furthermore, structural factors like changes in grid usage tariffs and the end of certain regulatory mechanisms add a layer of uncertainty and drive prices up. For a food manufacturer, forecasting the electricity price for 2025 and beyond becomes a complex but essential exercise for budget planning.

The volatile evolution of electricity prices on European wholesale markets.

Diagnosing Your Consumption and Identifying Action Levers

Before negotiating contracts or producing your own energy, the first fundamental step is to understand precisely where, when, and how your company consumes energy. A thorough diagnosis is the foundation of any energy optimization strategy. It allows you to stop being a victim of your bill and start actively managing it.

Step 1: Map Key Energy Consumption Areas

A detailed consumption analysis almost always reveals that a few areas account for the bulk of expenses. In the food industry, the breakdown is often as follows:

- Industrial Refrigeration (40% to 60%): Compressors, evaporators, cold rooms, freezing tunnels.

- Steam and Heat (20% to 30%): Boilers, ovens, pasteurizers.

- Auxiliary Processes (10% to 20%): Motors for conveyors, pumps, ventilation, compressed air, lighting.

This mapping, achieved through an energy audit or the installation of sub-meters, helps prioritize actions and target the most profitable investments.

Step 2: Identify Losses and Anomalies

Sources of energy waste are numerous and often invisible without proper monitoring. Monitoring tools, sometimes equipped with artificial intelligence, can track consumption in real-time and detect deviations. For example, a setpoint temperature in a cold room of -22°C instead of the standard -18°C may seem trivial, but it can lead to an electricity overconsumption of more than 10% for that area. Similarly, leaks in a compressed air system or faulty insulation are direct sources of financial loss.

Step 3: Benchmark Your Ratios Against Industry Averages

Comparing your performance to your peers is an excellent way to assess your efficiency. Agencies like the U.S. Environmental Protection Agency (EPA) or the Carbon Trust in the UK publish benchmarks and consumption ratios (e.g., kWh per ton of finished product) for various food industry sub-sectors. Benchmarking against these averages helps identify potential savings and set realistic improvement goals.

Industrial cold storage: the most critical consumption area.

Securing Your Electricity and Gas Contracts

Once consumption is better controlled, attention must turn to the contractual lever. Choosing the right purchasing strategy is just as crucial as energy efficiency for protecting margins. It’s about finding the right balance between seeking the best price and ensuring budget predictability.

Short-Term: Renegotiation and Indexation Clauses

In the face of volatility, a 100% fixed-price contract is not always the best solution, as it can be offered at a very high rate during uncertain times. Contracts with indexation clauses tied to spot markets can be attractive, provided the risks are well understood. The key is to renegotiate at the right time. It is often wiser to start discussions with your supplier or energy broker during periods of low seasonal consumption, rather than during a winter production peak when prices are high.

Mid-Term: Pooling and Group Purchasing

There is strength in numbers. For SMEs in the food industry, joining an energy purchasing group is a powerful strategy. By pooling the consumption volumes of several companies, it becomes possible to access pricing conditions typically reserved for large corporations. An energy broker plays a central role here by aggregating needs, launching tenders, and negotiating on behalf of the group, thereby providing volume leverage, better predictability, and increased margin protection.

Long-Term: PPAs and Local Green Energy

For very long-term visibility, more and more manufacturers are turning to Power Purchase Agreements (PPAs). These direct contracts with a renewable energy producer (solar or wind) allow companies to secure a fixed electricity price for periods of 10 to 15 years, or even longer. Beyond cost stability, this approach offers a significant image boost in terms of Corporate Social Responsibility (CSR), an argument increasingly valued by consumers and business partners.

Rooftop solar installation: a step towards self-consumption.

Comparative Table: Energy Contract Strategies

| Strategy | Duration | Advantages | Disadvantages | Best For |

|---|---|---|---|---|

| Fixed Price | 1-3 years | Total budget certainty, protection against price hikes | Potentially high premium, no benefit from market dips | Risk-averse companies needing stability |

| Indexed Price | 1-2 years | Benefits from market downturns, competitive initial price | Full exposure to volatility, risk of sudden spikes | Companies with strong cash flow, ability to absorb risk |

| Blended/Hybrid | 1-3 years | Balances risk and opportunity, flexible | Complex to manage, requires expertise | Most SMEs, guided by an energy broker |

| Group Purchasing | 1-2 years | Volume leverage, better negotiating power | Less customization, collective commitment | SMEs looking to pool resources |

| PPA (Long-term) | 10-20 years | Extreme stability, CSR benefits, predictable price | Long-term commitment, potential initial investment | Large corporations, decarbonization strategy |

Leveraging Incentives and Programs Available in 2025

Optimizing energy performance often requires investment in equipment or technology. Fortunately, numerous support programs exist to assist food manufacturers in their transition. Leveraging these incentives is essential to accelerate the return on investment for projects and create a virtuous cycle.

Energy Efficiency Incentive Programs

In many countries, programs similar to France’s Energy Savings Certificates (CEE) are a primary driver for financing the energy transition. The principle is often that energy suppliers are required to help their customers save energy or face penalties. This translates into a rebate or premium that can cover up to 40% of a project’s cost. Eligible projects in the food industry are numerous:

- Installation of heat recovery systems on refrigeration units or air compressors.

- Insulation of buildings and piping networks (for both cold and heat).

- Replacement of motors with high-efficiency models equipped with variable speed drives (VSDs).

As energy efficiency regulations tighten globally, these incentive schemes are a key opportunity to seize.

Industrial Decarbonization Funds & Government Grants

For more ambitious projects aimed at deep industrial decarbonization, governments have established specific funding channels (e.g., as part of national initiatives like France 2030). These funds can provide grants of up to 50% for large-scale projects, such as the electrification of boilers, implementation of cogeneration, or the use of green hydrogen. For example, a case study in a dairy plant showed an ROI of just 2.5 years on a cogeneration project thanks to such grants.

Regional Aid and Tax Credits

In addition to national programs, most regional or state governments offer their own support programs for business energy performance. This aid can take the form of direct grants, forgivable loans, or loan guarantees. It is crucial to check with local economic development agencies to discover opportunities specific to your territory.

Summary Table: Key Financial Incentives for 2025

| Program Type | Issuing Body | Amount / Rate | Eligible Work | Conditions |

|---|---|---|---|---|

| Energy Efficiency Incentives | Utility Companies / Gov. Agencies | Up to 40% of project cost | Insulation, refrigeration, heat recovery, motors, VSDs | Standardized or custom projects, application before work begins |

| Industrial Decarbonization Funds | National/Federal Gov. | Up to 50% (grant) | Electrification, cogeneration, hydrogen, low-carbon processes | Large investment projects (>€3M), significant CO2 reduction |

| National Innovation Funds | Government / R&D Agencies | Varies by call for projects | Innovation, deep decarbonization, disruptive tech | Innovative projects, R&D partnerships |

| Regional/State Aid | State/Regional Councils | 10-30% (variable) | Energy efficiency, renewable energy | Varies by region, SMEs often prioritized |

| R&D Tax Credits | Tax Authorities | ~30% of R&D expenses | Development of new energy-efficient processes | Justification of innovative character |

Optimizing Energy Performance Without Sacrificing Production

Energy efficiency should not mean lower productivity. On the contrary, modern technologies and best practices make it possible to produce as much, if not more, while consuming less. The goal is to decouple business growth from energy consumption.

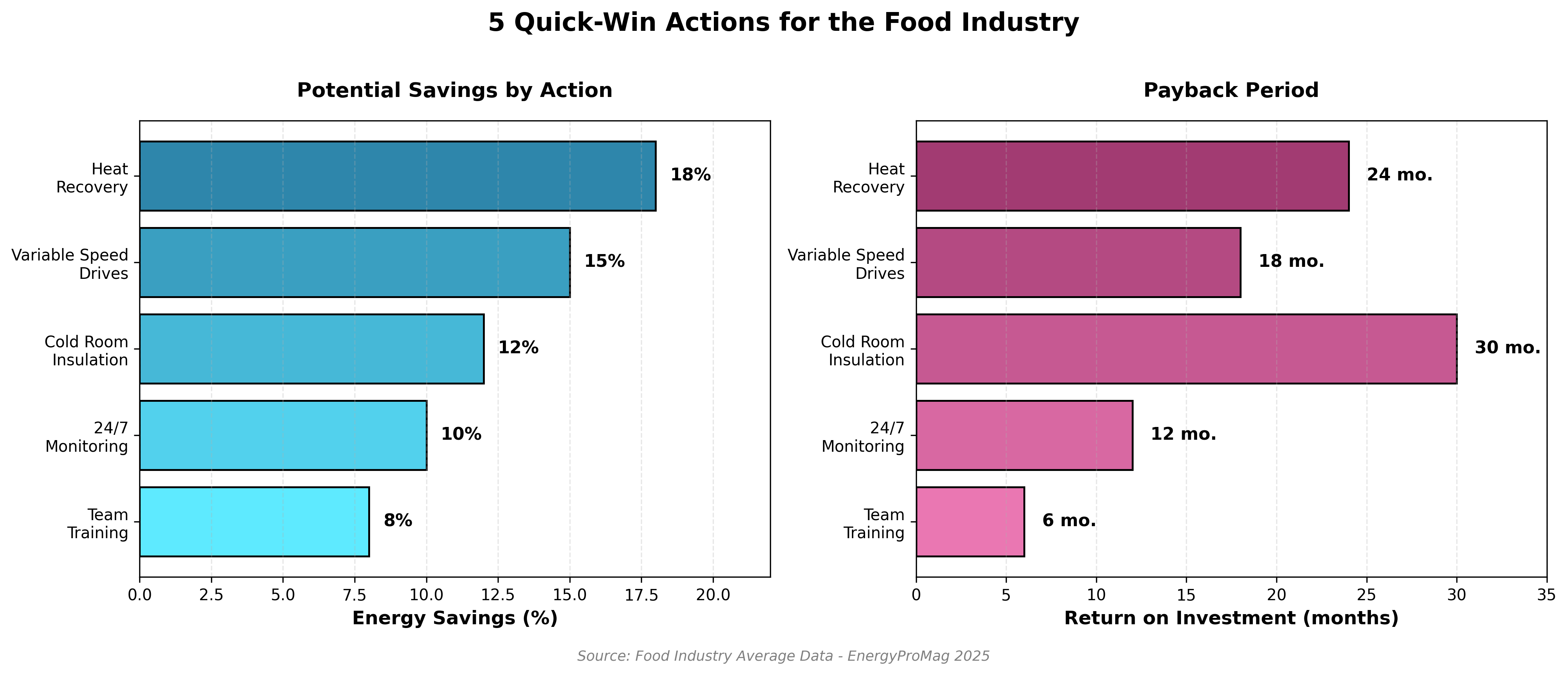

5 Actions with a Quick Return on Investment

Certain actions can yield significant savings with a very short ROI, often less than 3 years:

- Waste Heat Recovery: Use the heat generated by compressors or ovens to preheat water for sanitation or other processes.

- Variable Speed Drives (VSDs): Equip electric motors (pumps, fans) with VSDs to match their consumption to the actual load.

- Insulation of Key Points: Insulate valves, flanges, and other weak points in steam or chilled water networks.

- 24/7 Digital Monitoring: Install sensors and tracking software to monitor consumption in real-time and react immediately to deviations.

- Team Training: Train operators on best practices (e.g., keeping cold room doors closed, turning off unused machines).

Comparison of potential savings and return on investment time for key actions.

The Contribution of Digital Technologies

Digitalization is a powerful accelerator for energy performance. IoT (Internet of Things) sensors can collect thousands of data points across the entire production chain. Combined with artificial intelligence (AI) algorithms, this data enables predictive maintenance: AI can anticipate a failure or overconsumption in a piece of equipment before it even occurs. In some cases, AI-driven control systems have reduced peak consumption by 8% to 12%, thereby optimizing the portion of the bill related to subscribed power capacity.

Measure to Improve: The KPIs to Track

“You can’t improve what you don’t measure.” This adage is at the heart of any progress-oriented approach. Establishing Key Performance Indicators (KPIs) is essential for tracking gains and steering the strategy. Among the most relevant for the food industry are:

- kWh per ton of finished product: The basic indicator of production efficiency.

- Percentage of consumption from refrigeration: To monitor the most critical area.

- Energy cost as a percentage of revenue: To measure the overall economic impact.

Essential Energy KPIs Table

| Indicator | Unit | Objective | Tracking Frequency | Purpose |

|---|---|---|---|---|

| Specific Energy Consumption | kWh / ton produced | 5-10% reduction per year | Monthly | Measure overall production efficiency |

| Refrigeration Share | % of total consumption | Keep < 55% | Monthly | Monitor the most critical load |

| Energy Cost / Revenue | % of revenue | Keep < 10% | Quarterly | Assess overall economic impact |

| Heat Recovery Rate | % of waste heat recovered | Increase progressively | Bi-Annually | Measure thermal efficiency gains |

| Peak Power Demand | kW | Reduce peaks by 10% | Daily | Optimize capacity charges |

| CO2 Emissions | tons CO2 / year | Reduction aligned with targets | Annually | Regulatory compliance and CSR image |

How an Energy Broker Can Become Your Strategic Asset

Faced with the complexity of energy markets, incentive programs, and available technologies, food industry managers can quickly feel overwhelmed. This is where the specialized energy broker comes in, not as a simple intermediary, but as a true strategic partner.

Energy Risk Analysis and Purchasing Strategy

A broker’s first role is to audit the company’s consumption profile and its sensitivity to market risk. Based on the manager’s risk appetite, they will develop a tailored purchasing strategy: fixed-price, indexed, blended contracts, with options to lock in prices on futures markets, etc. They constantly monitor the markets and advise on the best times to negotiate or renegotiate contracts, helping to avoid pitfalls and seize opportunities.

Support with Financing and Compliance

A good broker does more than just negotiate prices. They also assist clients in preparing applications for grants and incentives. Their expertise helps maximize the chances of securing funding and accelerates the implementation of energy efficiency projects. They also provide regulatory monitoring to ensure the company’s compliance with obligations like building performance standards.

Client Case Study: A Mid-Sized Dairy Processing Company

Consider a dairy processing company with €30 million in revenue. By hiring an energy broker, it was able to:

- Renegotiate its electricity contract to a blended strategy, capturing market dips while securing a portion of its volumes.

- Identify 15% in potential savings through a heat recovery project on its refrigeration units.

- Obtain an incentive covering 35% of the investment.

The result: a 22% reduction in its overall energy budget within 12 months, while also improving its carbon footprint.

Table: ROI Examples by Project Type

| Project Type | Average Investment | Annual Savings | ROI (without incentives) | ROI (with incentives) | Example |

|---|---|---|---|---|---|

| Compressor Heat Recovery | €50k – €150k | €20k – €50k | 2-3 years | 1.5-2 years | 200-employee dairy plant |

| Variable Speed Drives (VSDs) | €30k – €80k | €15k – €35k | 2-2.5 years | 1.2-1.8 years | Ready-meal factory |

| Cold Room Insulation | €80k – €200k | €25k – €60k | 3-4 years | 2-2.5 years | Refrigerated warehouse |

| IoT Monitoring + AI | €20k – €60k | €15k – €40k | 1.5-2 years | 1-1.5 years | Multi-process site |

| Solar Installation (self-consumption) | €200k – €500k | €40k – €100k | 4-6 years | 3-4 years | Factory with available roof space |

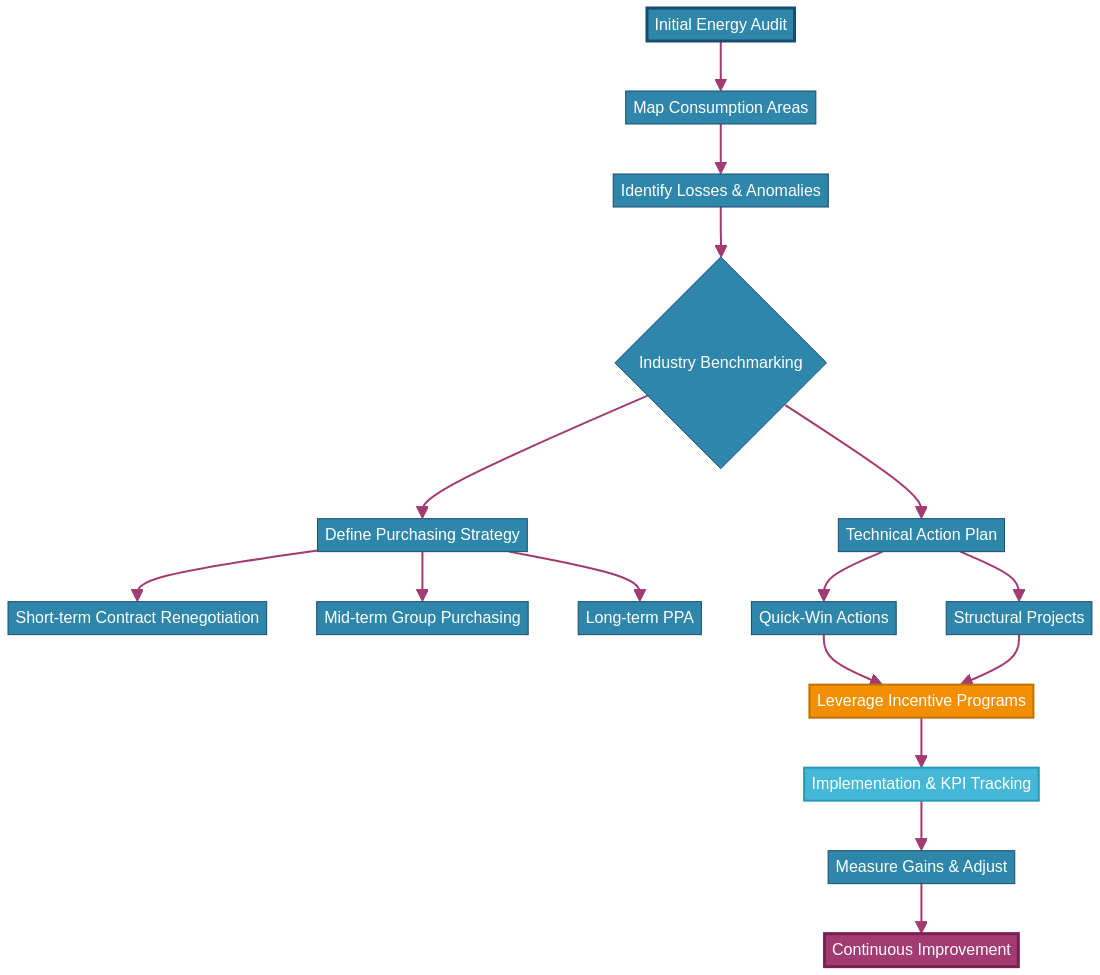

The Energy Optimization Process: A Structured Approach

Flowchart of the complete energy optimization process for the food and beverage industry.

FAQ: Your Questions About Energy in the Food Industry

This section answers the most frequently asked questions from managers and production heads in the sector.

1. What is the average cost of energy in the food industry?

On average, energy accounts for 6% to 12% of production costs. This figure can exceed 20% for highly energy-intensive industries like frozen foods or ready-made meals.

2. How can we quickly reduce the electricity bill in a food processing plant?

Start with quick-win actions: optimize refrigeration temperature setpoints, install VSDs on large motors, and launch a program to detect compressed air leaks.

3. Which energy efficiency projects are most profitable?

Heat recovery from refrigeration units and compressors, as well as insulation of distribution networks (steam, chilled water), generally offer the best returns on investment and are well-supported by incentive programs.

4. What contract strategy should we choose in 2025: fixed or variable?

There is no one-size-fits-all answer. A blended strategy, combining a fixed-price portion for budget certainty and a variable-price portion to take advantage of market dips, is often the most relevant. The guidance of an energy broker is recommended to define it.

5. Is it mandatory to use a broker to renegotiate contracts?

No, it is not mandatory, but it is highly recommended. A broker brings in-depth market knowledge, negotiating power through the volumes they represent, and considerable time savings for managers.

6. How does a Power Purchase Agreement (PPA) work?

A PPA is a long-term contract (10-20 years) where you buy your electricity directly from a renewable energy producer at a pre-agreed price. This provides complete long-term visibility on your costs.

7. Which KPIs should be tracked to measure energy savings?

The three key indicators are: kWh per ton of product, energy cost as a percentage of revenue, and the breakdown of consumption by use (refrigeration, cooking, etc.).

8. What is the difference between an energy broker and a supplier?

The supplier sells the energy, while the broker is an independent intermediary who compares offers from multiple suppliers to find the best solution for your needs. The broker works for you, not the supplier.

9. What is the average ROI for an energy efficiency project?

For quick-win actions (VSDs, heat recovery, insulation), the return is typically 1.5 to 3 years. For more structural projects (cogeneration, solar), expect 3 to 6 years, which can be reduced with incentives.

10. How do we access energy efficiency incentives in practice?

Contact your energy supplier or a specialized broker before starting your projects. They will help you prepare the application, choose eligible standardized operations, and maximize the value of your incentives.

Conclusion: From Constraint to Opportunity

Energy price volatility is not inevitable. For the food and beverage industry, it is a call to action to fundamentally rethink its energy strategy. By combining a precise diagnosis, a wise purchasing policy, relevant technological investments, and the mobilization of available aid, it is possible to transform this threat into a powerful competitive lever.

Energy efficiency not only improves profitability but also strengthens the company’s brand image and its resilience to future crises. In a context where decarbonization is becoming a regulatory and commercial imperative, companies that anticipate these transformations will be well-positioned for the years to come. The support of an expert, such as an energy broker specializing in the food industry, can be decisive in navigating this complexity and securing your company’s margins for the long term.

The time for waiting is over; the time for strategic and informed action is now.

About EnergyProMag.com

EnergyProMag.com is the leading magazine for european energy professionals.