Table of Contents

The Broker’s Decisive Moment: From Cost Optimizer to Climate Catalyst

European energy brokers face an unprecedented opportunity disguised as a challenge. The European Union’s commitment to climate neutrality by 2050—codified in the European Green Deal and accelerated by the “Fit for 55” legislative package—represents the most ambitious economic transformation in modern history. Every business, from the local bakery to the multinational manufacturer, must fundamentally reimagine how it sources, consumes, and reports its energy.

This transition is creating a huge expertise gap. While large corporations are hiring sustainability teams and carbon consultants, the 25 million SMEs across Europe—representing 99% of all businesses and 66% of total employment—lack the resources, knowledge, or time to navigate this complexity on their own.

This is where the energy broker, historically focused on negotiating electricity and gas contracts at the lowest possible rate, comes in. This traditional value proposition is rapidly being commoditized by digital comparison platforms that can analyze hundreds of rates in seconds.

But a new value proposition is emerging, one that positions brokers not as transaction facilitators, but as sustainability architects guiding companies through the most complex regulatory, technical, and strategic transformation they have ever faced.

The stakes are extraordinary. Companies that fail to decarbonize face rising carbon taxes, estimated to add between €45 and €120/MWh to fossil-fueled electricity by 2030. Companies without credible sustainability strategies risk exclusion from supply chains as corporate buyers demand emission reductions from their suppliers. Those that cannot demonstrate ESG performance will face higher capital costs as banks and investors filter out climate risks. Regulatory non-compliance carries penalties of up to €50,000 and more per violation for several EU directives.

But the opportunity is just as significant. The European renewable energy market will require over €600 billion in annual investments through 2030, creating massive demand for PPA (Power Purchase Agreement) brokerage. Carbon accounting and ESG reporting services represent a market opportunity of over €15 billion for consulting firms. Companies that successfully reduce their energy consumption by 30-40% while decarbonizing create both cost savings and a competitive advantage. Brokers that establish their sustainability credentials now will dominate client relationships for the next decade.

This article examines how forward-thinking energy brokers are transforming into climate leaders, what capabilities they need to develop, and how to build a sustainable business model around sustainability services.

Brokers who master this transition will not just survive—they will thrive in Europe’s greatest economic transformation since industrialization.

Understanding the Regulatory Basis: The EU Green Deal Framework

Before brokers can guide their clients toward decarbonization, they need to deeply understand the regulatory architecture that drives it.

The European Green Deal: Ambition Meets Implementation

Announced in December 2019 and accelerated after the COVID crisis, the Green Deal commits the EU to climate neutrality by 2050, with net-zero greenhouse gas emissions across all sectors, a 55% reduction in emissions by 2030 compared to 1990 levels (compared to the previous target of 40%), and a clean energy transition doubling renewable energy deployment rates, phasing out coal, and electrifying transport and heating.

These high-level commitments translate into dozens of specific regulations affecting how businesses purchase and use energy.

Fit for 55: The Legislative Engine

The “Fit for 55” package (named after the 55% reduction target) includes 13 interconnected legislative proposals that have a direct impact on energy supply.

Simple contentSimple contentSimple content

| Heading #1 | Heading #2 | Heading #3 |

|---|

Understanding why companies are willing to pay premium fees for sustainability services requires examining their specific challenges.

Challenge 1: Scope 2 Emissions Dominate Carbon Footprints

Pour de nombreuses entreprises, l’électricité achetée représente 40 à 70 % de l’empreinte carbone totale. Cela signifie que l’approvisionnement en énergie est le levier de décarbonation le plus impactant. Mais aborder le Scope 2 nécessite de comprendre la comptabilité basée sur la localisation par rapport à celle basée sur le marché (Protocole GHG), la qualité et l’additionnalité des Garanties d’Origine (GO), la correspondance temporelle et géographique, et la hiérarchie des instruments contractuels (les PPA sont mieux classés que les GO non groupées)

Challenge 2: Science-Based Targets (SBTi) Require Verified Progress

More than 5,000 European companies have committed to SBTi trajectories, requiring an absolute annual emissions reduction of at least 4.2%. SBTi specifically requires that Scope 2 reductions use market-based accounting and that renewable energy purchases meet quality criteria. Buying cheap GOs and claiming to be “100% renewable” will not satisfy SBTi validation.

Challenge 3: Carbon Pressure in the Supply Chain

Large companies are passing on decarbonization requirements to their supply chains. Apple, Microsoft, Amazon, and IKEA require their suppliers to use 100% renewable electricity. For the SMEs supplying these companies, sourcing renewable energy isn’t an option—it’s a condition of market access.

Challenge 4: ESG Screening of Investors and Lenders

Les banques et les fonds d’investissement filtrent de plus en plus les risques climatiques. Les entreprises ayant de mauvaises stratégies énergétiques font face à des coûts d’emprunt plus élevés, à l’exclusion des fonds d’investissement durables et à des valorisations plus faibles. Les directeurs financiers se soucient désormais de l’intensité carbone de l’énergie, pas seulement de son coût, car elle affecte la structure du capital.

Challenge 5: Talent Attraction and Retention

Sustainability commitments impact employer branding. 68% of European millennials prefer employers with strong ESG credentials. Companies that market their headquarters as “100% renewable energy-powered” benefit from recruitment advantages.

The common thread is clear: all these challenges require the same core capability: a sophisticated renewable energy supply, aligned with recognized standards, verified by credible documentation, and integrated into strategic decision-making. This is precisely what next-generation energy brokers can provide.

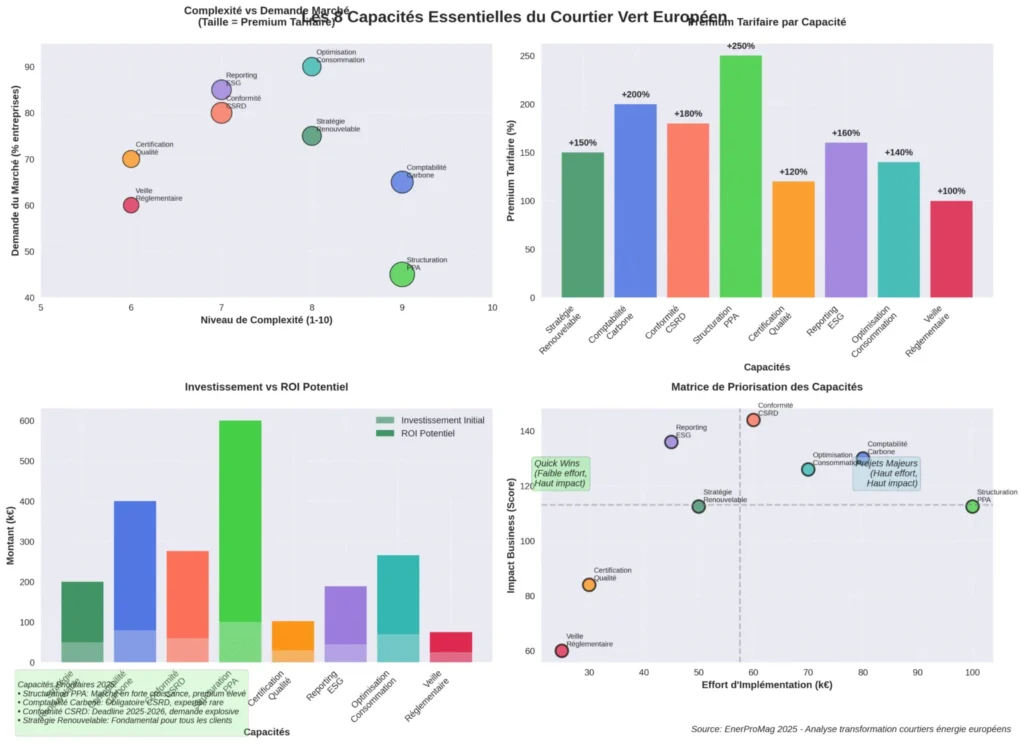

The Green Broker Service Portfolio: Eight Essential Capabilities

Transforming from price broker to sustainability partner requires developing new service capabilities. Here are the eight essential pillars.

Capacity 1: Renewable Energy Procurement Strategy

This service involves helping clients navigate the renewable supply hierarchy and select optimal approaches.

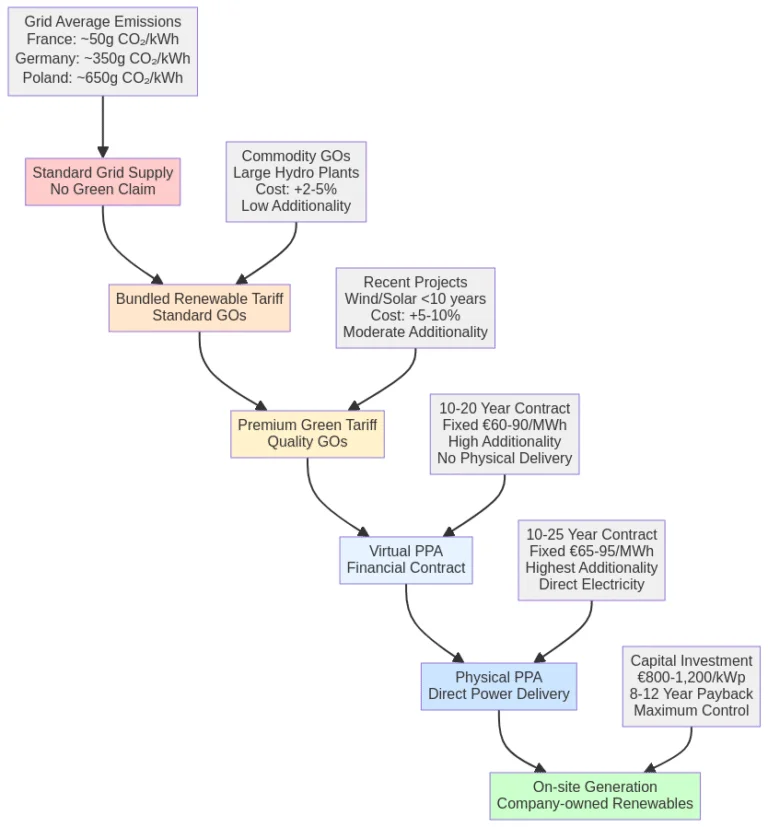

The renewable energy ladder progresses from lowest to highest quality:

1. Standard Grid Supply (No Green Claim): Average grid carbon intensity.

2. Bundled Renewable Tariff with Standard GOs: The supplier purchases Guarantees of Origin to match consumption. Additional cost of +2-5%. Low additionality.

3. Premium Green Tariff with Quality GOs: GOs from recent projects, preferably in the same country. Additional cost of +5-10%. Moderate additionality.

4. Virtual PPA (Financial Contract): Financial hedging with a renewable producer. Term of 10-20 years. Fixed cost of €60-90/MWh. High additionality.

5. Physical PPA (Direct Energy Delivery): Direct contract with a renewable producer for the delivery of electricity. Term of 10-25 years. Fixed cost of €65-95/MWh plus balancing costs. Highest additionality.

6. On-Site Self-Consumption: Rooftop solar or company-owned wind turbines. Capital investment of €800-1,200/kWp for solar. Maximum additionality and autonomy.

Capacity 2: Carbon Accounting and Emissions Reporting

Brokers must offer carbon accounting services, calculating Scope 2 emissions using the GHG Protocol’s location-based and market-based methods. This includes certificate tracking, documentation for auditors, and integration with ESG reporting platforms such as EcoVadis or CDP.

Capacity 3: Energy Efficiency and Optimization Consulting

Using smart meter data, brokers can identify waste, model efficiency scenarios, and recommend investments in energy-saving technologies. This service transforms the broker into an energy management consultant, creating value beyond procurement.

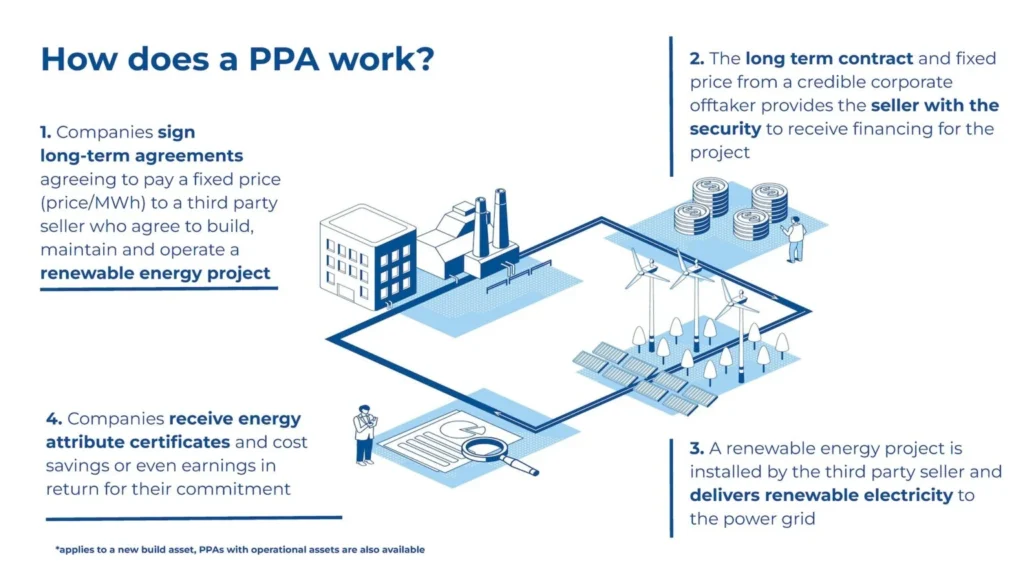

Capacity 4: Structuring and Intermediation of PPAs

This is a valuable skill. The broker acts as a transaction advisor, helping companies find suitable PPA projects, negotiate contract terms, assess risks, and manage the long-term relationship with the developer.

Capacity 5: Regulatory Compliance Management

Brokers must become regulatory experts, helping clients comply with the CSRD, EED, Tertiary Decree, and other national mandates. This includes preparing reports, managing submissions on government platforms, and maintaining regulatory intelligence.

Capacity 6: Energy and Climate Risk Management

This goes beyond simple price hedging. Brokers must model a client’s exposure to physical climate risks (e.g., the impact of drought on hydropower) and transition risks (e.g., future carbon tax increases).

Capacity 7: Electrification Strategy

As businesses electrify their vehicle fleets and heating processes, their electricity consumption profile is changing dramatically. Brokers can help model these new loads, plan charging infrastructure, and optimize contracts for new peaks in demand.

Capacity 8: Emerging Energy Technologies Consulting

Forward-thinking brokers advise clients on emerging technologies such as battery storage, green hydrogen production and carbon capture solutions, helping them prepare their energy strategies for the next decade.

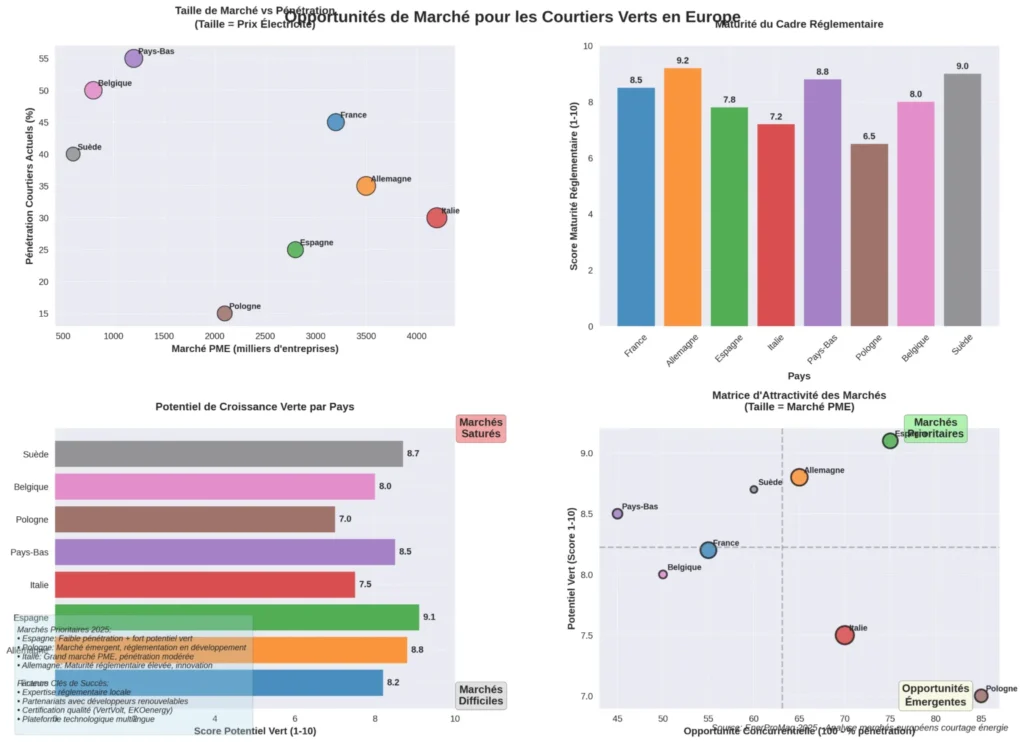

Regional Market Opportunities for Green Brokers

| Heading #1 | Heading #2 | Heading #3 |

|---|---|---|

| Simple content | Simple content | Simple content |

Frequently Asked Questions (FAQ)

What is the concrete difference between a standard Guarantee of Origin (GO) and a “high quality” GO?

A standard GO is an electronic certificate proving that a MWh of electricity was produced from a renewable source. However, most standard GOs on the European market come from large Norwegian or Alpine hydroelectric power plants, which have long since been depreciated. Purchasing these GOs does not finance the construction of new renewable capacity; this is referred to as low “additionality.”

A high-quality GO has additional attributes that ensure a greater environmental impact. These attributes include:

• Additionality: The GO comes from a recent renewable power plant (generally less than 5-10 years old) whose financing depended on the sale of these certificates. Purchasing this GO directly contributes to the construction of new infrastructure.

• Geographic Proximity: The GO is issued in the same country or market area as the consumption, supporting the local grid. •Time Matching: Electricity production is correlated (hourly or quarterly) with consumption, ensuring that green energy is produced when you need it.

• Trust Labels: Certifications such as EKOenergy or the VertVolt Level 2 Label in France guarantee that the project meets strict ecological criteria beyond simple energy production. The role of the green broker is to guide the client towards the GO quality level that matches their sustainability ambitions and budget, clearly explaining the trade-off between cost and impact.

My company is an SME. Aren’t Power Purchase Agreements (PPAs) reserved for multinationals?

Historically, yes. PPAs were complex and large-scale contracts. However, the market has evolved to become accessible to SMEs thanks to several innovations, in which brokers play a key role:

• Aggregated (or Consortium) PPAs: A broker can aggregate the demand of several SMEs to collectively sign a PPA with a large renewable project. Each SME benefits from the advantages of a large-scale PPA (competitive pricing, additionality) for a fraction of the volume.

• Standardized PPAs: Platforms and law firms are developing standardized PPA contracts that significantly reduce the costs and complexity of negotiation.

• Smaller PPAs: More and more developers are offering PPAs for smaller volumes (from 1-5 GWh/year), directly targeting the SME and mid-cap market.

• Virtual PPAs: As they are financial contracts, virtual PPAs are easier to divide and allocate to multiple smaller buyers. A knowledgeable broker can assess whether your SME is a good candidate for an aggregated PPA, find you a consortium, and manage the process on your behalf.

What is the exact role of a broker in preparing a CSRD-compliant sustainability report?

The broker’s role is to act as the “energy data custodian” for the CSRD report. They do not write the final report, but they provide the auditable data and expertise needed for the energy section. Their tasks include:

1. Data Collection and Validation: Aggregate consumption data from all company sites, ensuring its accuracy.

2. Double Carbon Accounting: Calculate Scope 2 emissions using the two methods required by the CSRD: the location-based method (based on the grid average) and the market-based method (based on specific contracts).

3. Documentation of Contractual Instruments: Provide all documents proving renewable energy purchases: GO contracts, PPA contracts, certificates with unique serial numbers, and proof of cancellation in the national registry.

4. Audit-Ready Reporting: Present all this information in a clear, traceable format that third-party auditors can easily verify.

5. Strategic Consulting: Advise the company on how to improve its energy metrics year-over-year to demonstrate a credible decarbonization trajectory. In essence, the broker transforms complex energy bills into clear, reliable, and compliant sustainability information.

How can a broker help me comply with the Tertiary Decree in France?

The Tertiary Decree is a major opportunity for brokers to demonstrate their value beyond procurement. Comprehensive support includes:

1. Initial Declaration Phase:

Help define the scope of buildings subject to the Decree, choose the most advantageous reference year (between 2010 and 2019), and complete the initial declaration on ADEME’s OPERAT platform.

2. Analysis and Action Plan:

Analyze detailed consumption data to identify the main expenditure items. Based on this, the broker helps develop a prioritized action plan: low-cost, rapid actions (optimizing HVAC settings, raising employee awareness), medium-term investments (LED relamping, insulation), and major projects (complete renovation, rooftop solar installation).

3. Networking:

Connecting the client with a network of qualified partners to implement the actions: thermal design firms, installers, and energy service companies (ESCOs).

4. Annual Monitoring:

Manage annual consumption reporting on OPERAT and track progress toward the 40/50/60% reduction targets. The broker becomes the building’s energy compliance project manager, coordinating procurement, efficiency, and reporting.

Ressources

Links