The European energy market is undergoing a profound transformation. Between electricity market reform, decarbonization targets, and price volatility, companies face unprecedented complexity. This guide, written by industry experts, is your roadmap to turning this complexity into a competitive advantage.

Network interconnection is at the heart of the European energy strategy.

Introduction: Why Europe is the Epicenter of Energy Brokerage

The European energy landscape is undergoing a profound and accelerated transformation. The major electricity market reform, which came into effect in July 2024, the ambitious target of 45% renewable energy by 2030 [1], and the scheduled phase-out of national mechanisms such as ARENH in France by December 31, 2025, are reshaping the rules of the game. For companies, this new era presents both challenges and significant opportunities.

The facts are clear: the European Union collectively reduced its gas demand by more than 100 billion cubic meters between August 2022 and December 2023 [2], illustrating the rapid pace of change. In this context, electricity prices fluctuate dramatically, ranging from €69.74/MWh on the wholesale market in France to over 40 c€/kWh for end consumers in Germany, creating fertile ground for cost optimization for multinational companies.

This guide provides you with a comprehensive and actionable analysis of energy brokerage at the European level. We will decode the operation of national markets, the regulatory specificities of each country, cross-border purchasing strategies, and concrete opportunities for savings. Whether you are an exporting SME, an industrial group established in multiple countries, or an energy buyer seeking to optimize your contracts, this document is your strategic ally to master the complexity of the European energy market.

Table of Contents

1. Anatomy of the European Energy Market: The Fundamentals

To navigate the European market effectively, it is essential to understand its fundamental mechanisms. From its gradual construction to price formation, each element has a direct impact on your energy bills.

The Single Energy Market: A Gradual Construction

The European energy market was not built in a day. It is the result of three successive waves of liberalization (1996-1998, 2003, 2009) that dismantled national monopolies to create a competitive and interconnected space. This market rests on three pillars:

1.Liberalization of production and supply: End of historical monopolies such as EDF in France, Enel in Italy, or E.ON in Germany.

2.Physical interconnections: More than 420 interconnections enable electricity and gas exchanges between countries, promoting price convergence [3].

3.Regulatory harmonization: Common directives are established at the EU level, although their transposition may vary from one member state to another, creating a complex regulatory patchwork.

How Is the Price of Electricity Formed in Europe?

The wholesale price of electricity in the EU is determined by the “merit order” principle. The price is set by the last power plant needed to meet demand. Historically, this was often gas-fired plants, which explains why a rise in gas prices could impact all electricity prices.

The 2024 reform aims to mitigate this mechanism by promoting long-term contracts, such as Power Purchase Agreements (PPA) and Contracts for Difference (CfD), to partially decouple renewable energy prices from the volatility of fossil fuels.

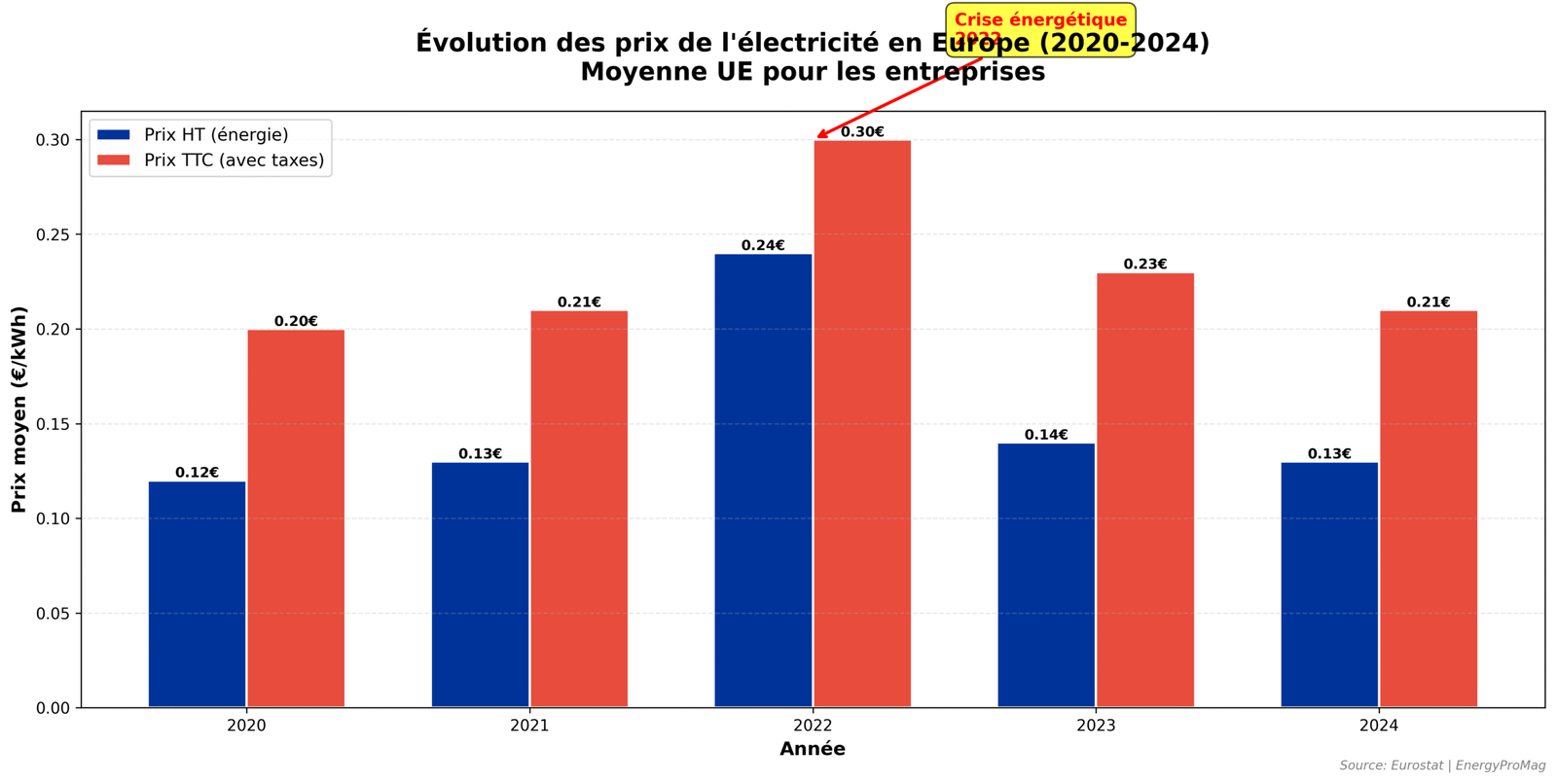

This infographic illustrates price volatility and the impact of the 2022 crisis, highlighting the importance of robust purchasing strategies.

Energy Exchanges: Who Really Sets the Prices?

Several trading platforms play a crucial role in price formation across Europe:

| Exchange | Reference Market | Key Role |

| EEX (Germany) | Electricity (Futures) | European Energy Exchange, benchmark for futures contracts. |

| EPEX Spot | Electricity (Spot) | Day-ahead and intraday market for Western Europe. |

| TTF (Netherlands) | Natural Gas | Main benchmark for gas prices in Europe. |

| PEG (France) | Natural Gas | Point d’Échange Gaz, the second most liquid gas hub in Europe. |

| Nord Pool | Electricity (Spot) | Historic market for Nordic countries, pioneer of liberalization. |

These exchanges, accessible via platforms like EEX or EPEX Spot, are where supply and demand meet, determining wholesale prices that serve as the basis for supplier contracts.

2. Overview of Energy Markets by Country: Opportunities and Pitfalls

Europe is a mosaic of energy markets, each with its own rules, production mix, and price dynamics. An effective pan-European purchasing strategy relies on a nuanced understanding of these local differences.

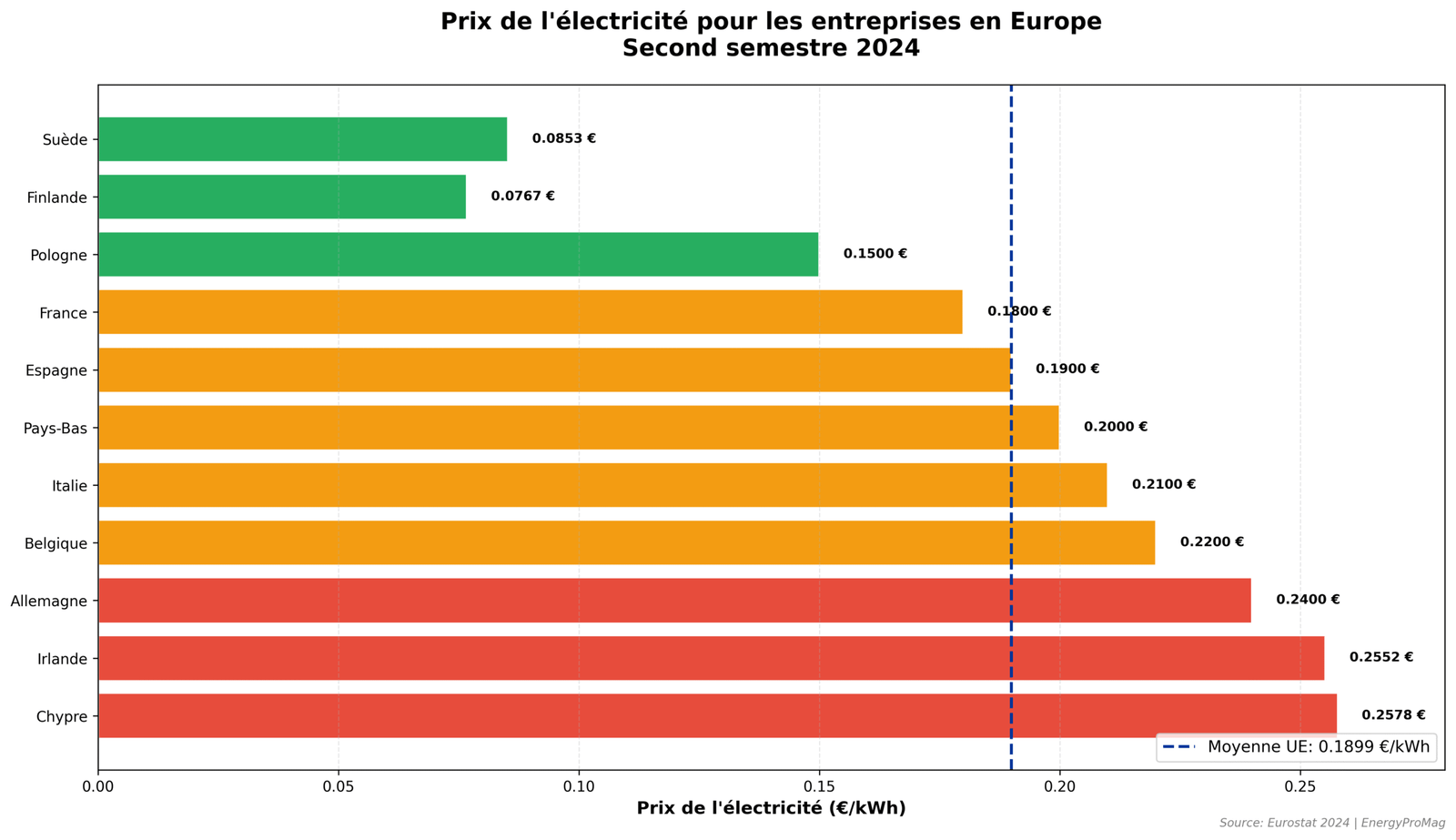

Electricity prices for businesses vary significantly across the EU, creating opportunities for arbitrage and optimization.

France: The Nuclear Model in Full Transition

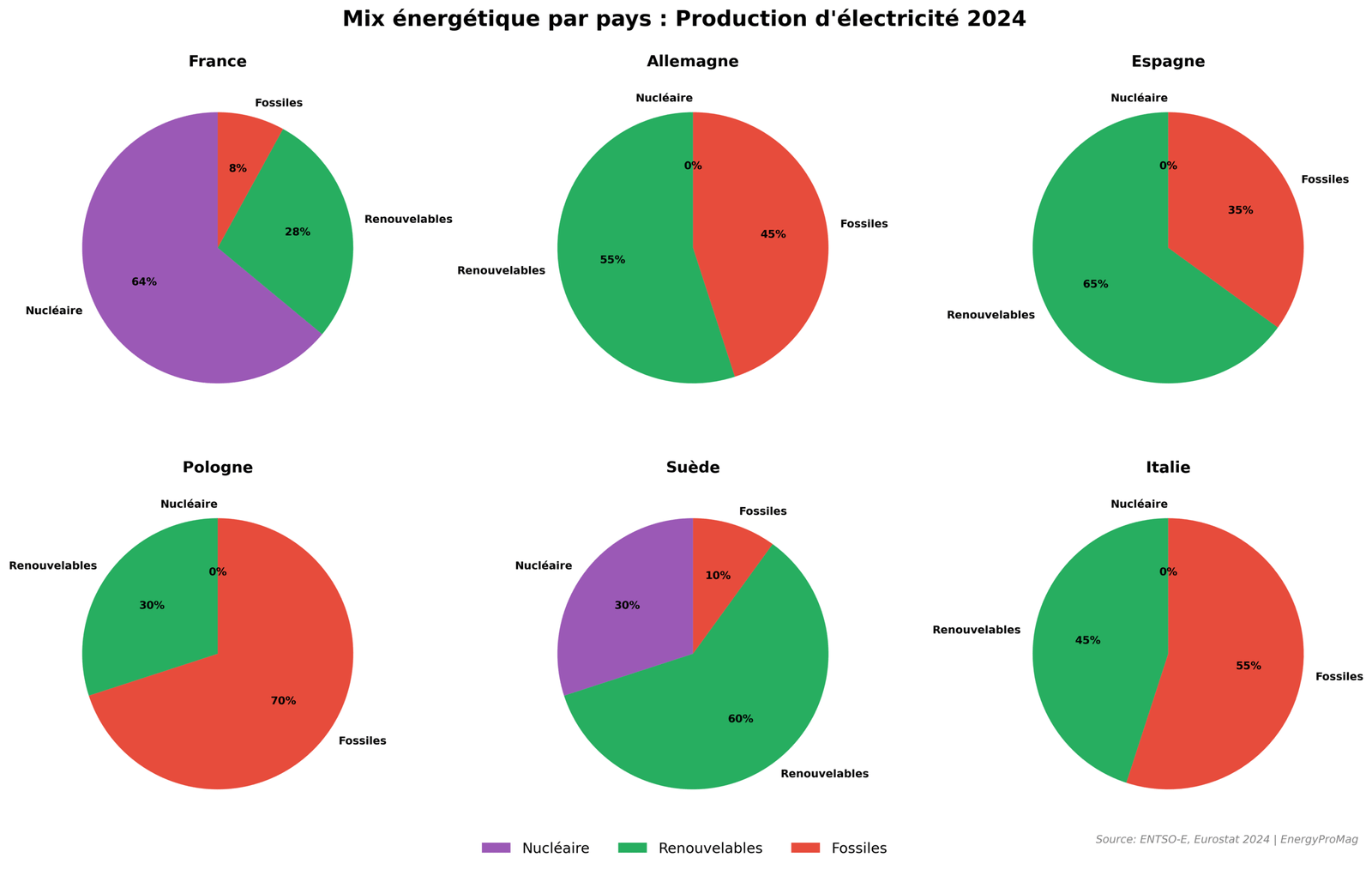

•Energy mix: Dominated by nuclear power (around 64%), supplemented by renewables (28%) and a small share of fossil fuels (8%).

•Electricity prices: Structurally competitive thanks to the nuclear fleet, but the end of ARENH (Regulated Access to Historic Nuclear Electricity) on December 31, 2025, will reshuffle the cards and expose companies to greater volatility.

•Regulation: A dense framework including mechanisms such as Energy Savings Certificates (CEE), TURPE (Public Electricity Network Usage Tariff), and the Tertiary Decree, which mandates consumption reductions. The key regulator is the Energy Regulatory Commission (CRE).

Germany: The Industrial Giant with High Prices

•Energy mix: Following the nuclear phase-out in 2023, Germany relies heavily on renewables (over 50%) but also on coal and gas, making it sensitive to fossil fuel price fluctuations.

•Electricity prices: Among the highest in Europe for end consumers, largely due to taxes and levies financing the energy transition (Energiewende).

•Opportunities: The market is very mature and competitive, offering negotiation margins. Tax exemptions exist for energy-intensive industries. The regulator is the Federal Network Agency (BNetzA).

The energy mix varies drastically from one country to another, directly influencing price structures and CO2 emissions.

Spain: The Mediterranean Solar Champion

•Energy mix: European leader in solar energy and strong wind production. This predominance of intermittent renewables leads to high price volatility.

•Opportunities: Ideal for spot purchasing strategies, especially during peak solar production hours when prices can become very low or even negative. Flexible companies can gain significant advantage.

Italy: Between Gas Dependence and Solar Potential

•Energy mix: Heavy reliance on gas imports (over 70%), keeping prices above the European average. However, the country is experiencing a solar boom in the south.

•Specificity: The market is fragmented between the industrial and energy-intensive North and the solar-rich South, creating arbitrage opportunities for specialized brokers.

Poland: Transition Away from Coal

•Energy mix: Still largely dominated by coal (around 70%), but rapidly declining in favor of offshore wind and other renewables.

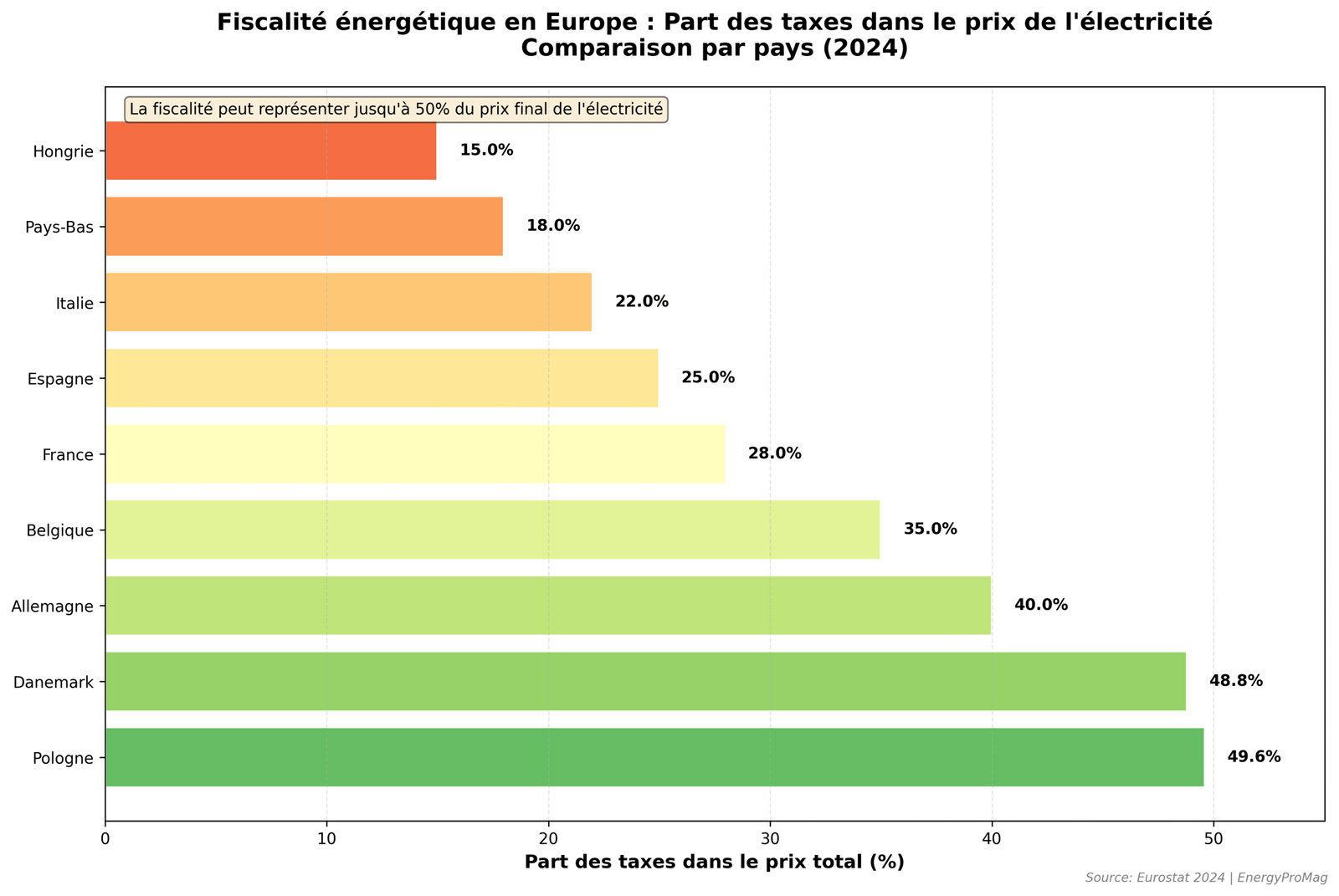

•Taxation: The country has one of the heaviest energy tax burdens in Europe, with nearly 50% of the final price composed of taxes to finance this accelerated transition.

The share of taxes in the final bill is a major differentiating factor among European countries.

3. European Regulation: What Every Broker Must Master

European energy regulation is a common foundation that influences all national markets. Mastering it is essential to anticipate changes, ensure compliance, and seize financing opportunities.

The Post-2024 Legislative Framework

The electricity market reform, adopted in 2024, introduced new rules aimed at protecting consumers from price volatility and accelerating the energy transition. The foundational texts every broker must know include:

•The Electricity Directive (2024): It redefines the market architecture to encourage investments in decarbonized energies.

•The RED III Regulation (2022): It sets the binding target of 45% renewable energy in the EU’s final consumption by 2030 [1].

•The Energy Efficiency Directive (2023): It requires Member States to achieve an average annual energy savings of 1.5%.

•The Carbon Market Reform (ETS): It strengthens the emission allowance trading system and extends it to new sectors (ETS2).

Regulatory Obligations by Type of Company

Obligations vary depending on the size and sector of the company. A broker must be able to guide their clients through this regulatory maze.

| Type of Company | Key Obligations |

| Large Enterprises (>250 employees or >€50M turnover) | – Mandatory energy audit every 4 years (standard EN 16247-1) |

•Sustainability reporting (CSRD) on energy performance. | | Tertiary Buildings (>1000m²) | – In France, the Tertiary Decree imposes consumption reduction targets (-40% by 2030).

•The European EPBD directive requires zero-emission buildings for new constructions starting 2028. | | All Actors | – Contribution to the carbon market (ETS) based on emissions.

•Compliance with national consumption reduction targets. |

Energy Savings Certificates (ESC): A Transnational Opportunity?

The ESC scheme, which obliges energy sellers to promote energy efficiency, is an interesting specificity. Although initiated by a European directive, its transposition varies greatly from country to country:

•France: A mature and complex ESC system, with a catalog of standardized operations.

•Italy: A similar mechanism with “white certificates” (TEE).

•United Kingdom: The Energy Company Obligation (ECO).

•Germany: No ESC system, but direct renovation subsidies.

A European broker can help navigate these different systems to optimize financing for energy efficiency projects across Europe.

4. Cross-Border Purchasing Strategies: Optimizing at the European Level

For multi-site companies, a pan-European approach to energy procurement is no longer an option but a necessity to remain competitive. It enables volume pooling, negotiating better terms, and implementing a coherent CSR strategy.

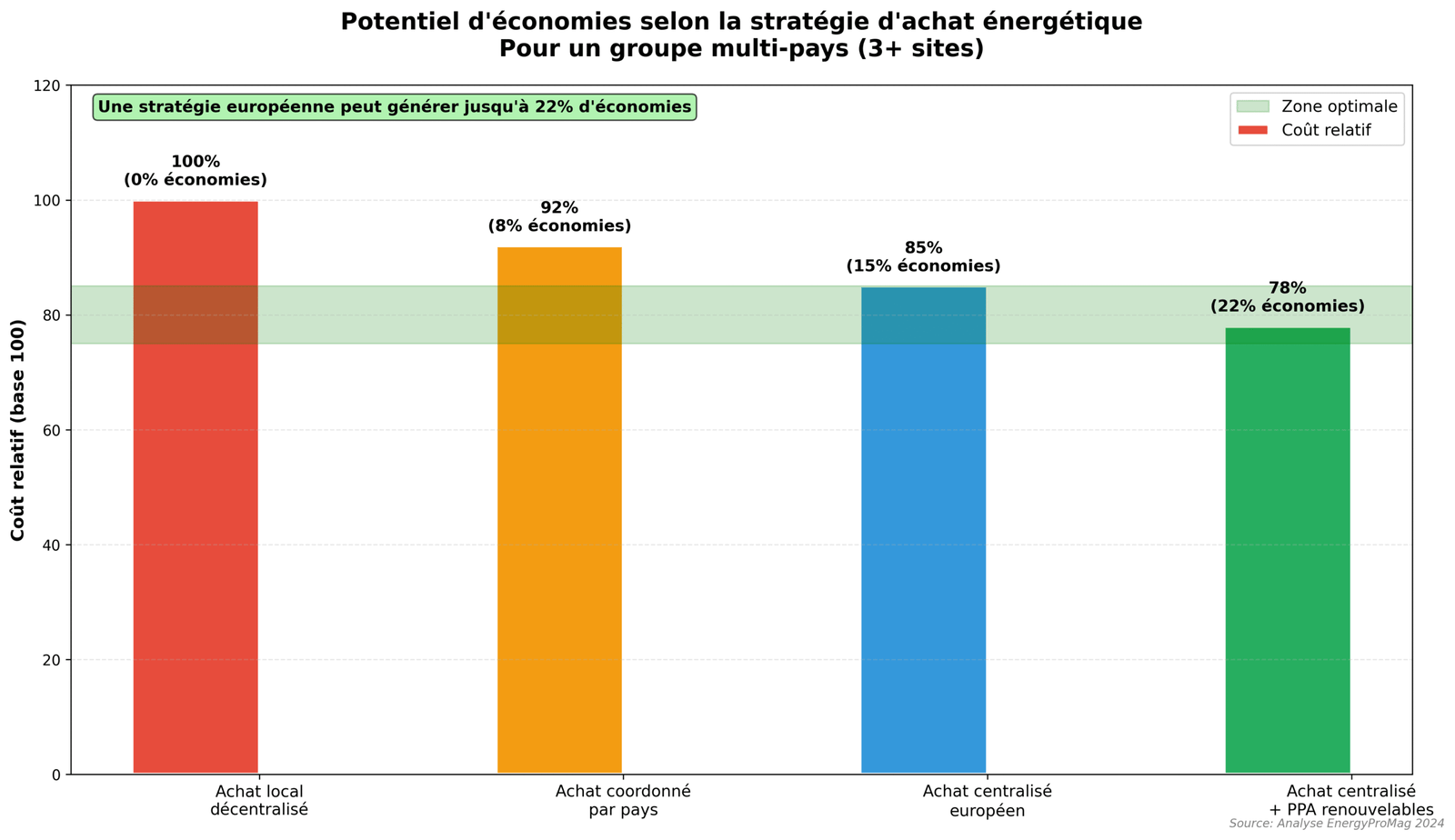

Shifting from local management to a centralized European purchasing strategy can generate over 20% savings.

The Multi-Country Strategy: For Whom and How?

This approach is mainly aimed at industrial groups, distribution networks, hotel chains, or data centers operating in at least 3 European countries. Three main models coexist:

1. Centralized Purchasing with a European Framework Agreement

The group negotiates a single framework agreement with a pan-European supplier, consolidating all volumes. Local addendums are then deployed.

•Advantages: Maximum bargaining power, pricing consistency, administrative simplification.

•Disadvantages: Contractual complexity (which law applies?), risk of missing local opportunities.

2. Coordinated Purchasing with a Common Strategy

Each subsidiary remains autonomous in its contracts but follows a common guideline (same contract type, same deadlines, etc.), often managed by a European broker.

•Advantages: Local flexibility, sharing of benchmarks among subsidiaries, optimization of schedules.

•Disadvantages: Loss of volume bonus, more time-consuming coordination.

3. Decentralized Purchasing with Shared Expertise

Each site manages its contracts but benefits from shared expertise (digital platform, external consultant) for analysis and negotiation.

•Advantages: Maximum responsiveness to local conditions, legal simplicity.

•Disadvantages: No volume effect, resource dispersion.

Geographic Arbitrage and Interconnections

The cost difference of energy between countries can make geographic arbitrage relevant. For example, electro-intensive production is more profitable in France (cheap nuclear energy) than in Germany (high prices). The EU’s goal to reach 15% electrical interconnection by 2030 [4] aims to smooth these exchanges and strengthen price convergence. Companies located in well-interconnected areas (Benelux, France-Germany axis) are best positioned to benefit.

5. The Role of the European Broker: Expertise and Added Value

In the face of this complexity, the energy broker specializing in the European market becomes a strategic partner. Their added value far exceeds that of a local broker.

| Criterion | Local Broker | European Broker |

| National market knowledge | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Multi-country strategic vision | ⭐⭐ | ⭐⭐⭐⭐⭐ |

| Cross-border benchmarking | ⭐⭐ | ⭐⭐⭐⭐⭐ |

| Pan-European supplier network | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| EU regulatory support | ⭐⭐ | ⭐⭐⭐⭐⭐ |

A European broker offers high value-added services, such as pan-European market intelligence, multi-market coverage optimization, support for European PPAs, and the provision of a unified digital platform for a 360° view of consumption and costs.

6. Practical Cases and Checklist

Checklist for a Successful European Energy Strategy

1.Phase 1: Diagnosis (Months 1-2): Map all sites, contracts, consumption, and costs.

2.Phase 2: Strategy Definition (Months 2-3): Choose the purchasing model (centralized, coordinated, decentralized) and define objectives.

3.Phase 3: Partner Selection (Months 3-4): Launch a call for tenders to select a European broker.

4.Phase 4: Negotiation and Implementation (Months 4-8): Initiate supplier consultations and negotiate contracts.

5.Phase 5: Monitoring and Continuous Optimization (From Month 6 onward): Establish consolidated reporting and track performance.

Mistakes to Avoid

•Neglecting local legal and tax specificities: A European framework agreement must always be validated and adapted locally.

•Underestimating the importance of taxation: Always compare costs including all taxes (TTC).

•Signing excessively long contracts during volatile periods: Favor durations of 2-3 years and stagger contract maturities.

7. Tools, FAQ, and Conclusion

Tools and Resources

•Monitoring Platforms: ENTSO-E Transparency Platform, EEX, ACER.

•Calculators: Electricity Map for real-time energy mix.

•Organizations: CRE, BNetzA, CEER.

FAQ: Your Questions About European Energy Brokerage

•Can a French broker negotiate everywhere in Europe? Yes, but their effectiveness depends on their local network. Prefer brokers with a physical presence or strong partners in key countries.

•Are cross-border PPAs possible? Yes, this is a strong trend. A company in France can sign a PPA with a solar park in Spain. Guarantees of origin ensure the traceability of green electricity.

•Should short-term or long-term contracts be favored in 2025? The downward price trend favors 2-3 year contracts to capture gradual decreases.

Conclusion: Europe, a Strategic Playing Field

The European energy market is more than just a cost center; it is a lever for competitiveness and sustainable performance. Companies that can navigate this complexity with a well-defined pan-European strategy and the support of an expert partner will come out ahead. Anticipation is key: the opportunities of 2026 and 2027 are being prepared today.

References

[1] European Parliament, “Internal Energy Market,” Thematic Factsheets on the European Union, 2023. https://www.europarl.europa.eu/factsheets/fr/sheet/45/marche-interieur-de-l-energie

[2] European Commission, “EU ensures energy security with coordinated measures,” 2024. https://commission.europa.eu/energy-strategy/energy-security-and-international-relations/eu-ensures-energy-security-coordinated-measures_en

[3] ENTSO-E, “Interconnected System,” 2024. https://www.entsoe.eu/data/map/

[4] European Commission, “Trans-European Networks for Energy (TEN-E),” 2023. https://energy.ec.europa.eu/topics/infrastructure/trans-european-networks-energy-ten-e_en

Article written by the EnergyProMag team – The expert media outlet for European energy brokerage. Updated October 2025.

Energy Brokerage Europe 2025: Complete Guide [Expert Tips]

Master European energy markets: country analysis, cross-border strategies, PPA insights. Save 12-18% on energy costs. Expert guide 2025 ⚡

4.7