The year 2026 is shaping up to be a major turning point for the electricity market in France and across Europe. With the end of the ARENH mechanism, the introduction of a new nuclear regulation, and ongoing changes in taxes and grid fees (TURPE), Small and Medium-sized Enterprises (SMEs) are facing a complex environment. Anticipating these changes is now crucial to protect their margins and ensure their competitiveness. In this comprehensive guide, EnergyProMag, your expert energy brokerage publication, breaks down the three likely price evolution scenarios and provides winning strategies for negotiating your energy contracts.

Table of Contents

2025 Review: A Year of Contrasts Before the 2026 Leap

To fully grasp the challenges of 2026, a look back at 2025 is essential. The market saw a notable drop in wholesale prices, but this apparent calm conceals structural shifts that will reshape the energy landscape.

The Wholesale Market: A Deceptive Decline

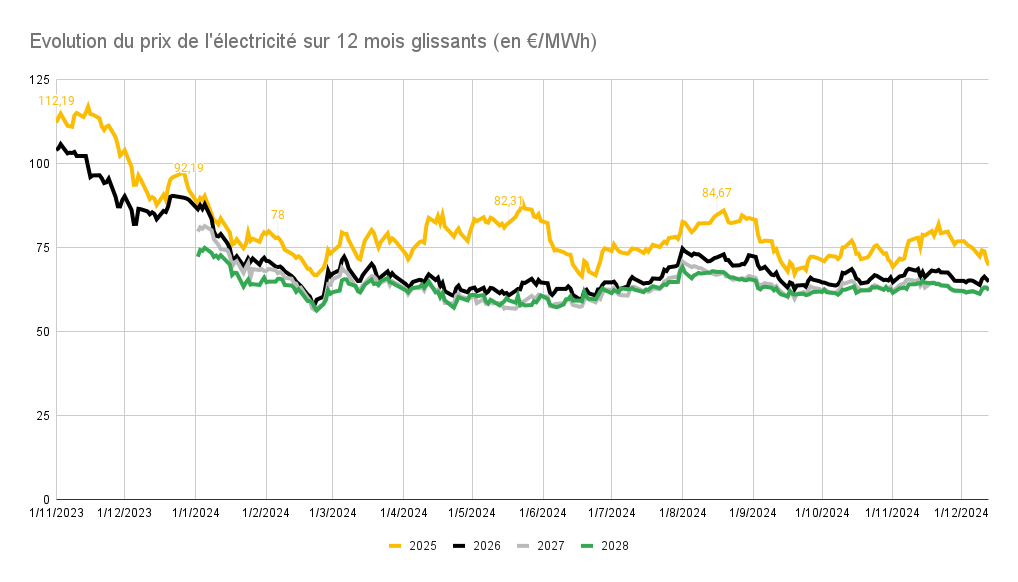

In 2025, the average spot price for electricity settled at €61/MWh, a significant decrease from €69/MWh in 2024. Several factors explain this downward trend:

•The restored performance of the French nuclear fleet: With an availability rate nearing 80%, nuclear production was a key stabilizing factor.

•A détente in the natural gas market: Lower gas prices directly impacted the production costs of thermal power plants.

•Favorable weather conditions: Mild weather helped moderate demand and boost renewable energy production.

Caption: The evolution of wholesale electricity prices in 2025, showing a downward trend despite persistent volatility.

As of October 3, 2025, the spot price of €69.74/MWh reminds us that volatility, although more contained than in 2022-2023, remains a reality. Forward prices for 2026, ranging from €66.74/MWh to €79.79/MWh, reflect the uncertainty hanging over the market.

The Ambivalent Impact of Government Measures

While small businesses benefited from an 18% drop in electricity prices since February 2025, this good news must be put into perspective. It was offset by an increase in taxation and the Public Electricity Network Usage Tariff (TURPE). The TURPE 7 tariff framework introduced a 7.7% increase in February 2025, while energy taxes began a gradual climb after the emergency measures of the 2022-2023 crisis.

Average Prices by Consumption Profile in 2025

To provide a concrete overview, here is an estimate of the average all-inclusive prices (supply, transmission, taxes, supplier margin) for a typical SME in 2025:

| Business Profile | Annual Consumption | Power Capacity | 2025 Price Range (VAT incl.) |

| Service Sector SME | 80 MWh/year | 36 kVA | €140-160/MWh |

| Industrial SME | 600 MWh/year | 250 kVA | €120-140/MWh |

| Restaurant | 40 MWh/year | 18 kVA | €160-180/MWh |

These benchmarks are essential for evaluating the offers you will receive for 2026 and measuring the effectiveness of your energy procurement strategy with an energy broker.

The 3 Price Scenarios for 2026: Between Optimism and Caution

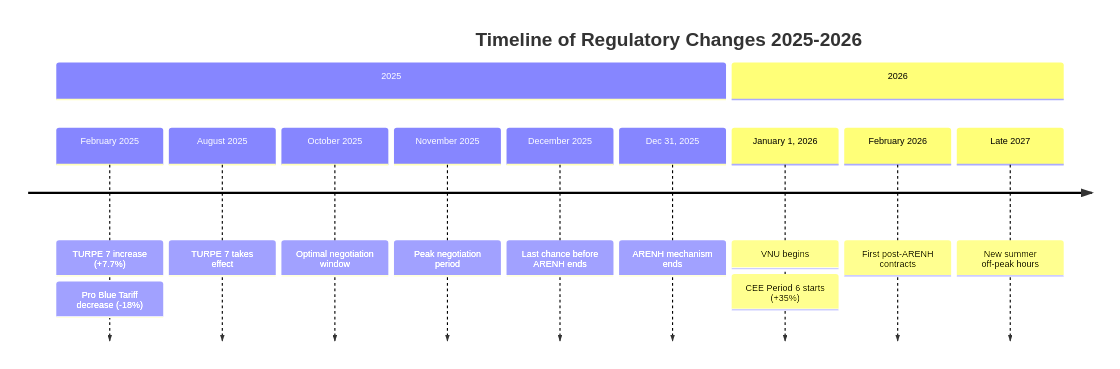

The year 2026 will be shaped by three major disruptions: the end of the ARENH mechanism on December 31, 2025, the implementation of the Universal Nuclear Levy (VNU), and the continued increase in Energy Savings Certificate (CEE) obligations. Faced with these upheavals, three price trajectories are emerging for SMEs.

Caption: A timeline of the main regulatory changes impacting the electricity market between 2025 and 2026.

Scenario 1: The Unexpected Drop (-5% to -10%)

•Probability: 30%

This optimistic scenario relies on a favorable alignment of factors: robust nuclear production (360-380 TWh), controlled gas and CO2 prices, and mild weather conditions. In this case, the average spot price could fall to between €55 and €60/MWh, providing a breath of fresh air for businesses.

•Impact for an SME (100 MWh/year): A potential saving of €600 to €1,200 compared to 2025.

•The catch: This scenario assumes geopolitical stability and a non-activated VNU, two highly uncertain variables.

Scenario 2: Relative Stability (0% to +5%)

•Probability: 50%

This is the central scenario, where the market finds a new equilibrium. EDF’s nuclear revenues, estimated by the French energy regulator (CRE) at €65.86/MWh for 2026, would remain below the VNU trigger threshold. The spot price would hold steady between €65 and €70/MWh. The increase in grid fees (TURPE) and pressure on CEEs would be contained.

•Impact for an SME (100 MWh/year): A virtually stable bill, with a variation of -€300 to +€500.

•A point of caution: The French independent electricity and gas association (AFIEG) warns that if market conditions tighten, the switch to the VNU could lead to a €15/MWh increase.

Scenario 3: The New Surge (+8% to +15%)

•Probability: 20%

The dreaded scenario, triggered by a combination of unfavorable factors: geopolitical tensions, a harsh winter, unplanned nuclear fleet maintenance, and a doubling of CEE obligations. The spot price could then climb to between €85 and €100/MWh.

•Impact for an SME (100 MWh/year): A significant additional cost of €2,000 to €3,500.

•Triggers to watch: Activation of the VNU (if EDF’s revenues exceed €78/MWh) and a surge in CEE prices.

Comparative Table of Scenarios for Your Budget

To help you visualize the concrete impact of these scenarios, here is a simulation for different SME profiles:

| Business Profile | Scenario 1 (Decrease) | Scenario 2 (Stability) | Scenario 3 (Increase) |

| Service Sector SME (80 MWh/yr) | €9,600 (VAT incl.) | €11,200 (VAT incl.) | €13,600 (VAT incl.) |

| Industrial SME (600 MWh/yr) | €72,000 (VAT incl.) | €84,000 (VAT incl.) | €102,000 (VAT incl.) |

| Restaurant (40 MWh/yr) | €4,800 (VAT incl.) | €5,600 (VAT incl.) | €6,800 (VAT incl.) |

| Variation vs 2025 | -8% to -10% | 0% to +3% | +10% to +15% |

This table highlights the importance of not being a market taker, but rather anticipating it. A sound energy brokerage strategy can help you get closer to Scenario 1, even if the market trends towards Scenario 3.

Decoding the New Mechanisms: VNU, TURPE 7, and CEE P6

To successfully navigate the 2026 market, it is imperative to understand the new rules of the game. The Universal Nuclear Levy (VNU), the TURPE 7 grid tariff, and Period 6 of the CEEs are three acronyms that every SME manager should master.

The Universal Nuclear Levy (VNU): The End of an Era

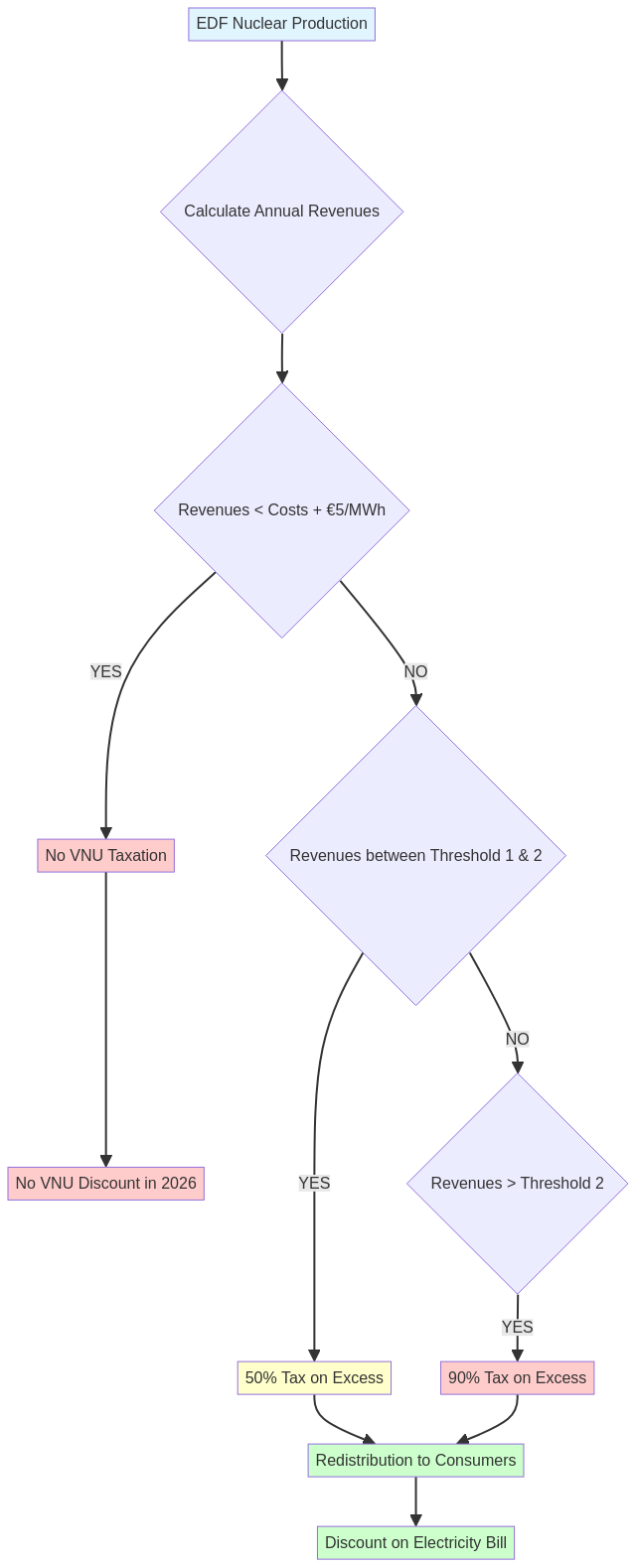

The VNU, which replaces the ARENH mechanism on January 1, 2026, is a genuine revolution in the French energy sector. Gone are the days when EDF was forced to sell part of its nuclear output at a fixed price of €42/MWh. Now, EDF will sell all its production at market price. To prevent a price surge, the government has implemented a progressive tax system on EDF’s revenues, the proceeds of which are then redistributed to consumers.

Caption: The taxation and redistribution mechanism of the Universal Nuclear Levy (VNU), which replaces ARENH in 2026.

How does it work?

The system is based on two tax thresholds: if EDF’s revenues exceed a certain level, 50% of the excess revenue is collected. Beyond a second threshold, the levy increases to 90%. These amounts are then redistributed to consumers as a discount on their electricity bills.

The reality for 2026: The CRE has deemed the application of the VNU in 2026 “very unlikely.” The estimated gap between EDF’s revenues and its production costs (€5.56/MWh) is too small. Conclusion: do not count on the VNU to lower your bill in 2026. It is a long-term protection mechanism, not a short-term subsidy.

TURPE 7: Grid Costs, a Factor Not to Be Overlooked

The TURPE 7, which took effect on August 1, 2025, covers the costs of electricity transmission. Although its average level is stable, it introduces significant structural changes for businesses.

Caption: The TURPE tariff finances the maintenance and modernization of the distribution network, a key element of which is the deployment of smart meters like Linky.

What changes for you:

•New off-peak hours: Starting in late 2027, new off-peak hours will be introduced in the afternoon during summer to better utilize surplus solar production. This is a major opportunity for companies that can shift their consumption.

•Surcharge for no smart meter: Sites not equipped with a Linky smart meter will face a surcharge of €6.48 every two months.

The financial impact is not neutral. For an SME, the 7.7% increase in February 2025 already represents an additional cost of about €25 per month.

CEE Period 6: The Hidden Cost of the Energy Transition

The sixth period of the Energy Savings Certificates (2026-2030) imposes increased obligations on energy suppliers (+35% compared to the previous period). This increase will inevitably be passed on to consumer bills.

The estimated impact: Expect an additional €3 to €5/MWh on your bill, representing an extra cost of €300 to €500 per year for a consumption of 100 MWh. This is a direct cost of the energy transition that must be integrated into your budget forecasts.

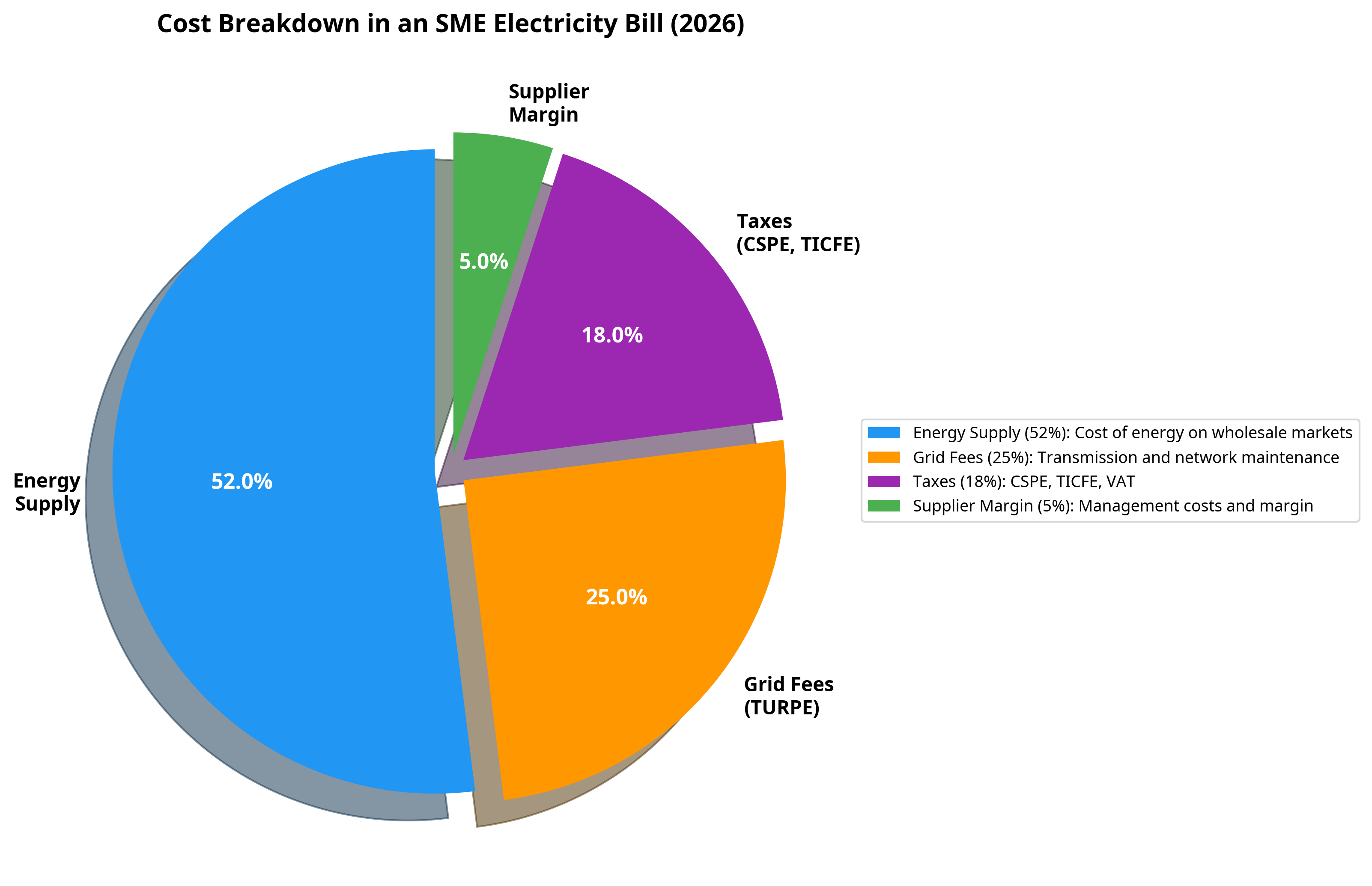

Understanding Your Bill Breakdown

Caption: A breakdown of the different components of an electricity bill for an SME in 2026.

Strategic Levers to Control Your Costs in 2026

Faced with these uncertainties, a wait-and-see approach is not an option. SMEs must adopt a proactive approach to turn risks into opportunities. An energy broker can assist you in implementing these strategies, but understanding their fundamentals is the first step toward mastering your costs.

Caption: Partnering with an expert energy broker is a strategic lever for optimizing contracts and protecting margins.

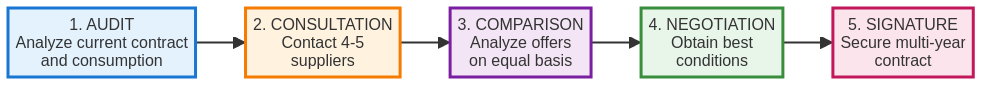

Strategy 1: Renegotiate Before January 2026 — Timing is Everything

The period from October to December 2025 is a unique window of opportunity. Suppliers, seeking visibility before the great leap into the post-ARENH world, are more inclined to grant discounts on multi-year contracts. Now is the time to launch a multi-supplier consultation and compare offers on an equal footing (price per kWh, offer type, included services).

Caption: The 5 key steps to successfully negotiating your 2026 electricity contract.

💡 EnergyProMag Tip: A 36-month fixed-price contract negotiated in November 2025 around €75-80/MWh (excl. VAT) could shield you from a potential increase to €90-100/MWh in a worst-case scenario.

Strategy 2: The Crucial Choice Between Fixed and Indexed Offers

The choice between a fixed and an indexed price is at the heart of your energy strategy. There is no one-size-fits-all answer; it all depends on your risk profile and your need for budget visibility.

| Offer Type | Advantages | Disadvantages | Best For? |

| Fixed Price | Total predictability, protection against price spikes, simplified accounting | Generally 5-10% more expensive, no benefit from price drops, early termination fees | SMEs with tight margins, price-sensitive sectors (hospitality, retail) |

| Indexed Price | Price aligned with the market, potential for savings | Full exposure to volatility, increased administrative burden, budget risk | Companies with consumption management capabilities, comfortable cash flow |

| Hybrid Contract | Flexibility of an indexed price with an option to fix, best of both worlds | Complexity, requires active market monitoring | Savvy SMEs, often with broker guidance |

Strategy 3: Pool Purchases for Better Negotiations: Buying Groups and PPAs

There is strength in numbers. Buying groups, whether professional (chambers of commerce, industry federations) or regional, allow you to pool volumes to access tariff conditions usually reserved for large accounts. Observed savings range from 8% to 15% compared to individual negotiations.

For larger consumers (>1 GWh/year), Power Purchase Agreements (PPAs), direct purchase contracts with renewable producers, offer very long-term visibility (10-20 years) and certified green electricity, disconnected from wholesale markets.

Strategy 4: Consumption Optimization, a Wellspring of Savings

The cheapest energy is the energy you don’t use. Optimizing your consumption is a powerful and sustainable lever.

•Manage your consumption: Take advantage of the future summer off-peak hours by shifting your processes. Shifting 30% of consumption can generate 5% to 8% savings on the total bill.

•Adjust your subscribed power capacity: An audit of your capacity can prevent overrun penalties or an oversized subscription. The savings can amount to several hundred euros per year.

•Invest in energy efficiency: Investments in insulation, LED lighting, or heat recovery are a double win, reducing your consumption and making you eligible for CEE aid.

Caption: Solar self-consumption, coupled with an energy efficiency strategy, is a sustainable solution to reduce grid dependency and control costs.

Support Schemes and Subsidies: A Lever for Your Energy Transition

The government and regional authorities offer several schemes to help SMEs cope with rising energy costs and invest in their transition. It is essential to be aware of them to mobilize all available resources.

Direct Aid for Bill Payments

For companies in the greatest difficulty, especially those whose energy expenses exceed 3% of their turnover, a payment support desk has been extended. This aid can cover up to 50% of the cost difference, capped at €4 million. State-Guaranteed Loans (PGE Resilience) are also an option to alleviate cash flow pressures.

Financing Your Energy Efficiency Investments

This is where the most structuring opportunities lie. Schemes like the France 2030 Heat Fund, regional ADEME aids, or the Energy Transition Tax Credit (CITE) can finance a significant part of your investments.

| Scheme | Aid Type | Eligible Projects | Amount |

| CEE (Energy Savings Certificates) | Grant (premium) | Insulation, heating, lighting, industrial processes | Up to 50% of the cost |

| Heat Fund (ADEME) | Grant | Waste heat recovery, biomass projects | Varies by project |

| Regional ADEME Aids | Grant, subsidized loan | Energy audits, high-performance equipment | Varies by region |

| Energy Transition Tax Credit | Tax benefit (30%) | Equipment and labor expenses | 30% of expenses |

The support of an energy brokerage expert often includes advice on preparing these financing applications, a valuable asset to maximize your chances of success.

FAQ: Your Questions on 2026 Electricity Prices

Our readers ask us daily about the future of their energy bills. Here are the clear and direct answers from our energy brokerage experts.

Will the price per kWh for businesses skyrocket in 2026?

No, a widespread explosion is unlikely. The most credible scenario is a moderate increase of 0% to 5% for most SMEs. However, this average masks significant disparities. The real difference will depend on your ability to anticipate and negotiate. A passive company could face an increase of +15% or more, while a proactive company, assisted by a broker, can aim for stability or even a decrease.

When should I renegotiate my electricity contract for 2026?

The ideal time is NOW, between September and November 2025. It is during this “power negotiation” period that suppliers are most competitive to secure their 2026 volumes. Waiting until December or January 2026 means risking being subject to prices set in the haste and volatility of the post-ARENH market.

What is the best strategy for an SME: fixed or indexed price?

It depends on your profile. To put it simply:

•SMEs with tight margins (artisans, retailers): Opt for the absolute security of a fixed-price contract for 24 or 36 months. You will have peace of mind.

•More structured SMEs with good consumption visibility: An indexed or hybrid contract can offer opportunities, provided you have the time and expertise to monitor the markets. This is where the support of a broker is invaluable.

How can an energy broker concretely help me?

An energy broker is your strategic ally. Their role goes far beyond simply comparing quotes. They provide:

1.In-depth market knowledge to buy at the right time.

2.Negotiating power thanks to the volumes they represent.

3.Technical expertise to decipher contracts and avoid pitfalls.

4.Valuable time savings by managing the entire process for you.

The return on investment is almost systematic, with average savings of 8% to 12% on the bill amount of the bill amount.

Conclusion: 2026, The Year of Strategic Foresight

The year 2026 should not be seen as an unavoidable fate, but as a historic opportunity to regain control of your energy strategy. The end of the ARENH mechanism does not mean an inevitable price surge, but it does mark the end of an era of relative simplicity. From now on, an SME’s energy performance will directly depend on its ability to anticipate, negotiate, and optimize.

The 3 Key Takeaways

1. Volatility is the New Paradigm

The main risk is not so much a sharp increase as it is increased exposure to wholesale market fluctuations. Companies that can manage their consumption and intelligently negotiate their contracts with the help of an energy broker will be the big winners.

2. Protection Mechanisms (VNU) Will Not Be a Sufficient Shield in 2026

For 2026, the CRE estimates nuclear revenues at €65.86/MWh, below the first trigger threshold. In concrete terms, no VNU levy would be activated, and no redistribution would appear on bills. Individual action and contractual strategy are paramount.

3. The Time to Act is Now

The decisions you make in the last quarter of 2025 will determine your energy competitiveness for the next three years. To anticipate is to protect your margins.

Your 3-Month Action Plan

📌 The 5 Key Figures to Remember for 2026

•€65.86/MWh: The estimated nuclear revenue by CRE, insufficient to trigger the VNU.

•+7.7%: The TURPE grid fee increase already applied in February 2025.

•+35%: The increase in CEE obligations that will weigh on your bills

•Q4 2025: The optimal window to renegotiate your contract with a broker.

•8-12%: The average savings you can achieve with expert energy brokerage support.

Article written by the EnergyProMag editorial team | October 2025

Sources: CRE (Commission de Régulation de l’Énergie), RTE (Réseau de Transport d’Électricité), Epex Spot, DGEC, AFIEG, Selectra