The cost of an energy broker is one of the most opaque topics in the sector. While regulations in countries like France mandate transparency, less than 30% of market players clearly display their rates. To shed light on these practices, EnergyProMag conducted an in-depth investigation, surveying 47 European brokers and analyzing over 200 brokerage agreements. This exclusive article reveals the real compensation ranges, the industry’s business models, and strategies for negotiating fair fees.

Caption: Negotiating energy contracts is a key stage where transparency on broker commission is paramount.

Table of Contents

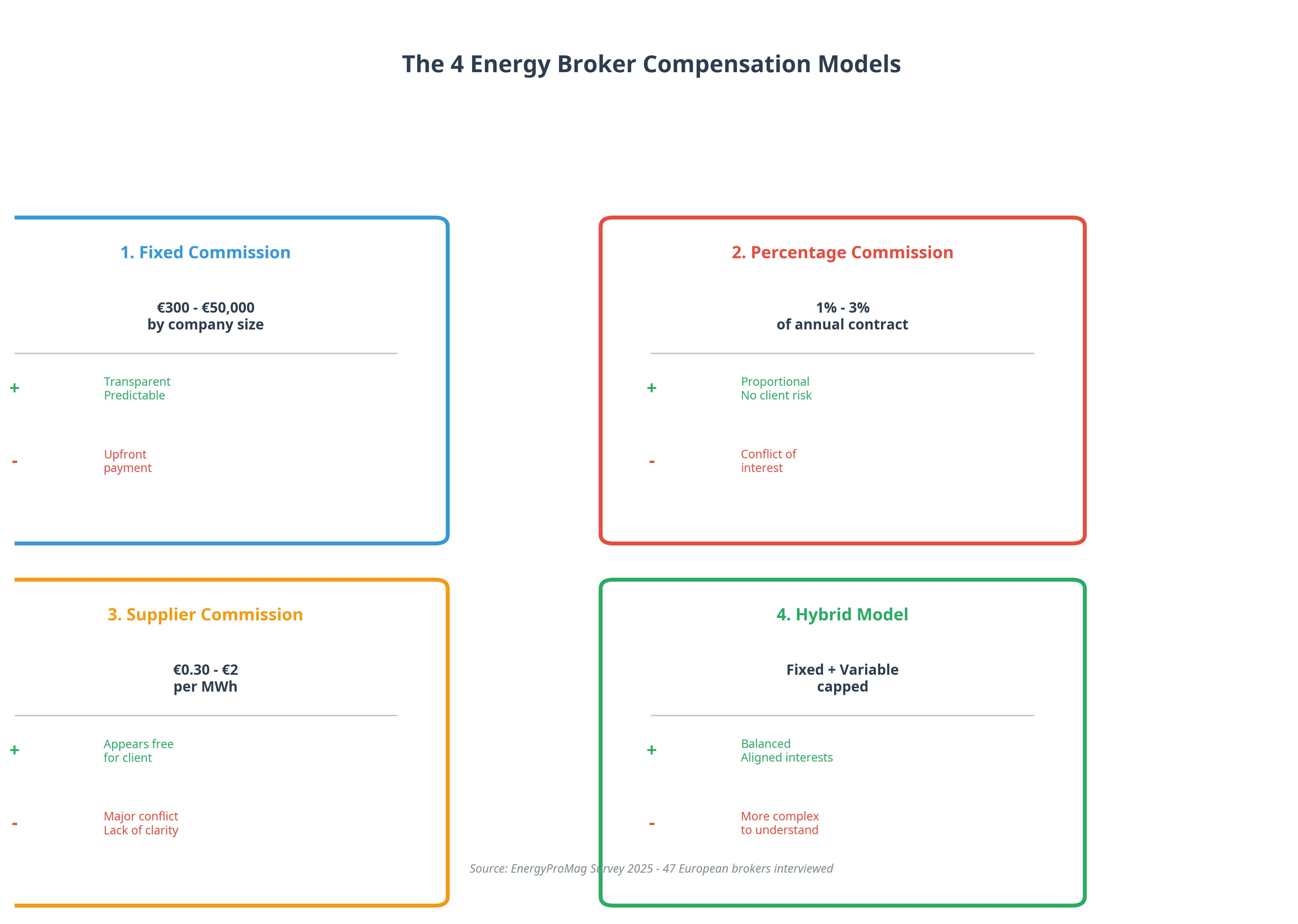

A Closer Look at the Four Compensation Models

The way an energy broker is compensated directly impacts the final cost for the company and can introduce biases in the advice given. Understanding these models is the first step to ensuring a balanced partnership. Our investigation reveals four main fee structures in the European market.

Caption: A comparison of the four main compensation models, their advantages, and their drawbacks.

1. The Fixed Commission

This model involves a flat fee, independent of the consumption or the contract amount. It is valued for its predictability and the absence of conflicts of interest, as the broker has no incentive to increase the contract price.

- Range in Europe (2025): From €300 for a very small business to over €50,000 for a large corporation.

- Main Advantage: Transparency and budget predictability.

- Notable Disadvantage: Payment is often required upfront.

2. The Percentage-Based Commission

Here, the compensation is a percentage of the annual energy contract value. This model directly links the broker’s fee to the size of the negotiated deal.

- Range in Europe (2025): Between 1% and 3% of the annual contract value.

- Main Advantage: Payment is only due upon success.

- Notable Disadvantage: A potential conflict of interest may arise, as the broker might be tempted to steer the client towards a more expensive contract to increase their commission.

3. The Supplier-Paid Commission

A dominant model in many markets, it is often presented as “free” for the client. In reality, the energy supplier pays the broker a commission (typically between €0.50 and €2 per MWh), which is then passed on in the final sales price.

- Main Advantage: No direct cash outlay for the business.

- Major Disadvantage: The conflict of interest is structural. The broker may be incentivized to favor suppliers offering the best commissions, rather than the most competitive offer for their client.

4. The Hybrid Model

This fast-growing model combines a fixed base fee with a variable, often capped, component. It represents a balance between guaranteeing compensation for the broker’s work and protecting the client from excessive costs.

- Typical Example: A fixed base of €1,000 + 1% of the annual amount, with a total cap of €5,000.

- Main Advantage: Aligns the interests of both parties and offers good predictability.

- Notable Disadvantage: Its more complex structure requires careful negotiation of the cap.

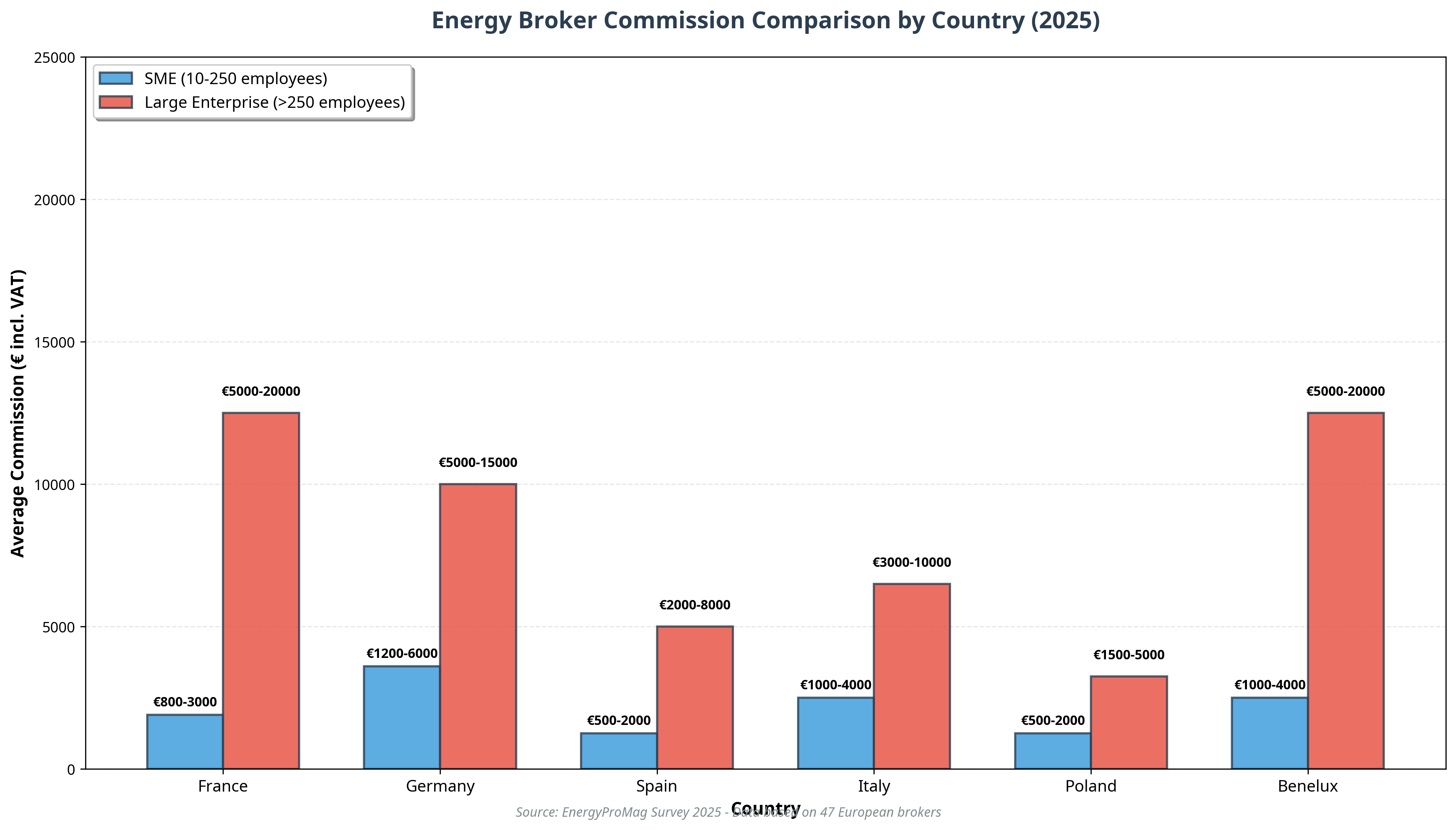

Fee Schedules by Country: A Multi-Faceted Market

An energy broker’s commission varies considerably from one country to another, depending on market maturity, regulatory complexity, and competitive structure. Our comparative analysis highlights significant differences across Europe.

Caption: Comparison of average commission ranges for SMEs and Large Enterprises in several European countries in 2025.

The French market, framed by strict regulation, stands out for its mandatory transparency. Germany, with its complex energy transition (Energiewende), justifies higher commissions with more advanced technical expertise. In Spain, the supplier-paid commission model is almost hegemonic, while in Italy, a strong negotiation culture plays a key role. Emerging markets like Poland offer more competitive rates but require increased vigilance on tax matters.

| Country | Dominant Model | SME Range (10-250 empl.) | Market Specificity |

|---|---|---|---|

| France | Supplier-Paid / Hybrid | €800 – €3,000 | Strict regulation and mandatory transparency. |

| Germany | Percentage-Based | €1,200 – €6,000 | Complexity related to the Energiewende and multiple taxes. |

| Spain | Supplier-Paid | €500 – €2,000 | Highly volatile market and opportunities in solar. |

| Italy | Mixed | €1,000 – €4,000 | Strong negotiation culture. |

| Poland | Fixed / Hybrid | €500 – €2,000 | Rapidly growing market, competitive rates. |

| Benelux | Fixed / Hybrid | €1,000 – €4,000 | Hub for pan-European brokers. |

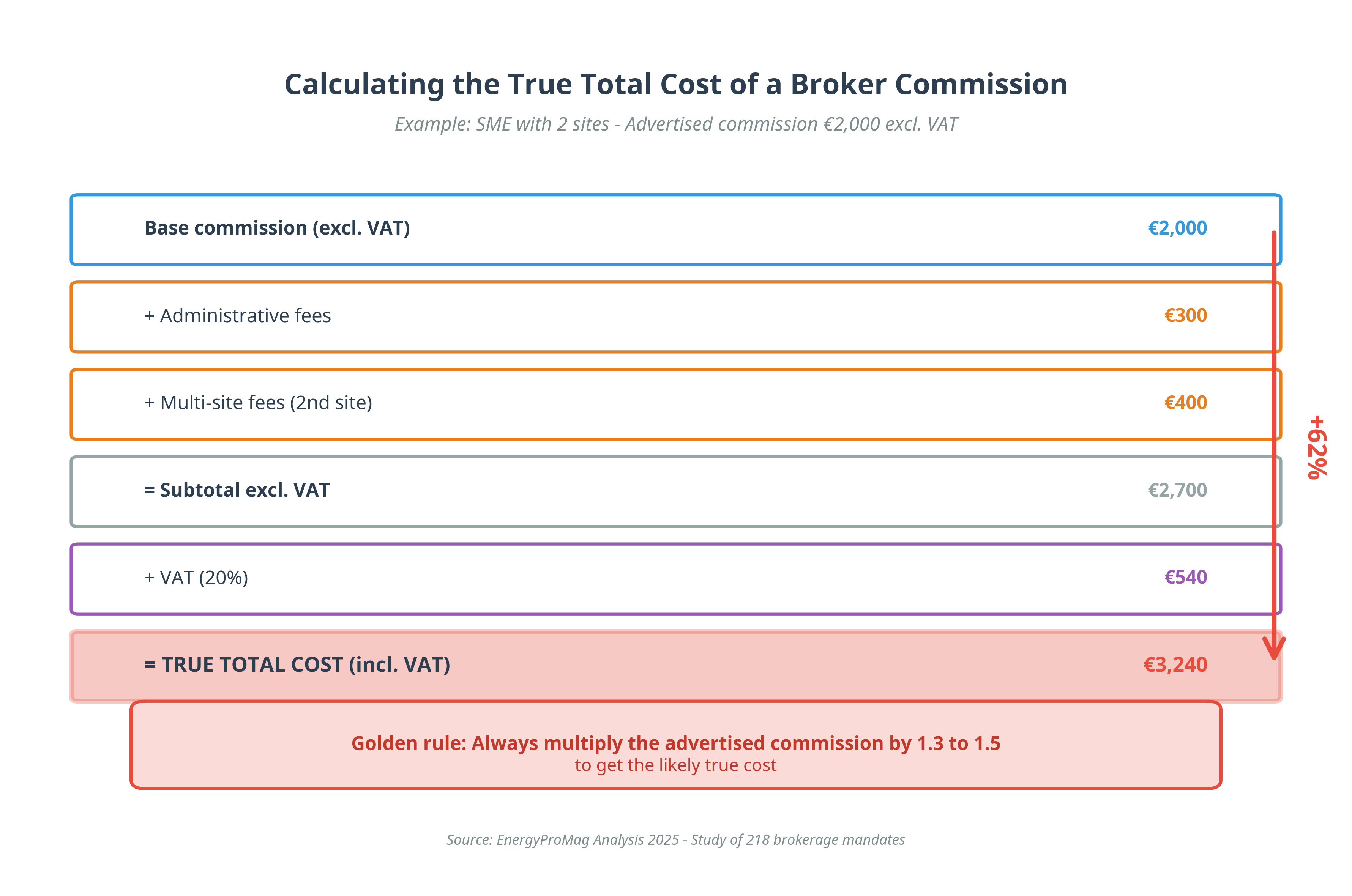

Beyond the Commission: Identifying and Avoiding Hidden Fees

The commission advertised by a broker often represents only the tip of the iceberg. Numerous ancillary fees can increase the final bill, sometimes by more than 60%. A careful reading of the brokerage agreement is essential to identify these additional costs and avoid unpleasant surprises.

Caption: The total cost can quickly exceed the initially advertised amount once ancillary fees and VAT are added.

Our analysis of over 200 mandates has identified the most common hidden fees. The table below details them and provides strategies for negotiation.

| Fee Type | Typical Amount | Legitimacy | Negotiation Tip |

|---|---|---|---|

| File/Admin Fees | €150 – €500 | Low | Request an “all-inclusive” offer where these fees are part of the main commission. |

| Preliminary Audit Fees | €300 – €1,000 | Debatable | Agree only if these fees are refunded upon signing a contract. |

| Early Exit Penalties | 30% – 50% of commission | High | Negotiate an exit clause without fees after a defined period (e.g., 12 months). |

| Renewal Fees | 50% of initial commission | Low | Limit the mandate to a fixed term without automatic commission renewal. |

| Multi-Site Surcharge | +20% to +30% | Debatable | Negotiate a degressive rate based on the number of sites to reflect economies of scale. |

| Annual Monitoring Fees | €200 – €800/year | Medium | Demand a detailed list of included services (reporting, monitoring, optimization) to justify these fees. |

The golden rule: Always request a detailed price proposal in euros Including All Taxes (VAT-inclusive) and not Excluding Taxes (VAT-exclusive). Multiplying the VAT-exclusive amount by a factor of 1.3 to 1.5 provides a more realistic estimate of the final cost.

How to Effectively Negotiate Your Broker’s Commission

Negotiation is a crucial step to obtain a fair commission that is aligned with the value provided by the broker. Proper preparation and the use of proven tactics can lead to substantial savings, in the range of 25% to 35% compared to the initial offer.

1. Systematic Competitive Tendering

The most effective strategy is to solicit at least three different brokers with an identical set of specifications. This competitive process encourages providers to present their best offer from the outset. It is essential to compare proposals on a VAT-inclusive basis to assess the full cost.

2. Demanding an Absolute Cap

For variable or hybrid compensation models, establishing an absolute cap is an indispensable protection. By setting a maximum limit on the commission (for example, €3,000 incl. VAT), the company protects itself against soaring costs, regardless of the final amount of the energy contract. A broker confident in their ability to generate savings will more readily accept this type of clause.

3. Formalizing Transparency in Writing

All conditions must be formalized in a contractual document. This should include the exact commission in euros (incl. VAT), an exhaustive list of all potential fees, a non-increase clause during the mandate, and the termination conditions. A broker’s refusal to commit to these points in writing is a major red flag.

4. Introducing a Performance Bonus

To align interests, a win-win compensation structure can be proposed. It consists of a moderate base commission, supplemented by bonuses conditional on achieving specific objectives: a certain percentage of savings compared to the previous contract, securing a share of green energy, etc. This model motivates the broker to maximize performance for their client.

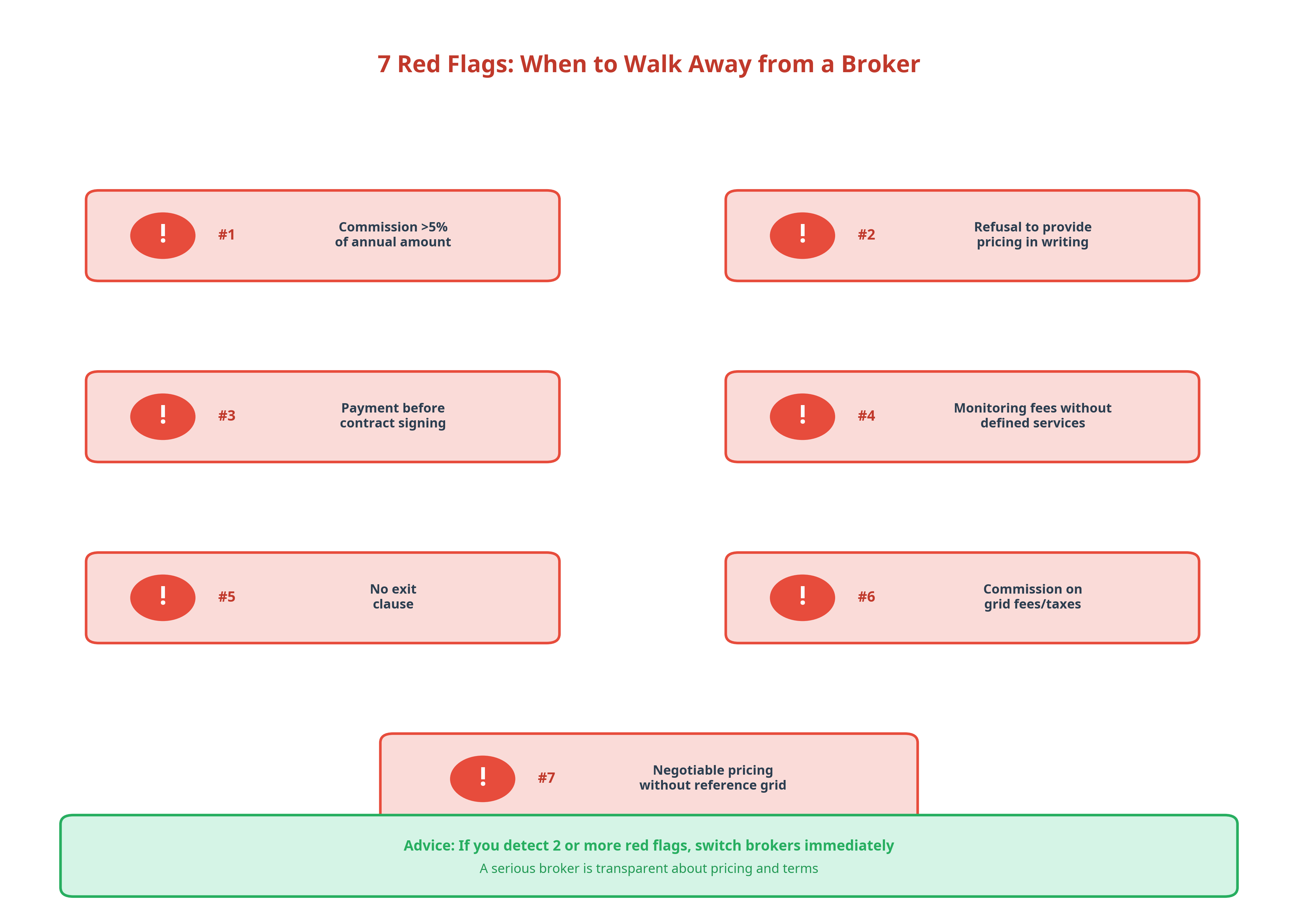

Red Flags to Recognize

The energy brokerage market, although increasingly regulated, still harbors some unscrupulous business practices. Knowing how to identify red flags is essential to protect yourself from abusive offers and risky partnerships. Our investigation has compiled the seven most revealing signs of a lack of professionalism or transparency.

Caption: These seven red flags should prompt extreme caution, or even an immediate breakdown of negotiations.

Here are the main points of vigilance to integrate into your selection process:

- A commission greater than 5% of the annual contract value: Such a commission is well above market standards and should be considered excessive.

- Refusal to provide rates in writing: A serious professional has no reason to hide their fee structure. Opacity is often a sign of hidden costs to come.

- A demand for payment before the supplier contract is signed: Except for a clearly established fixed commission, requiring a significant down payment before an offer has even been negotiated is a risky practice for the client.

- Billing for monitoring fees without defined services: Annual fees can be legitimate if they correspond to real services (monitoring, reporting, etc.). Without specific details, they amount to double billing.

- The absence of an exit clause in the mandate: A firm commitment over several years with no possibility of termination is a contractual trap that deprives the client of all flexibility.

- A commission calculated on the entire bill (including taxes and grid fees): The broker’s work focuses on the “supply” portion of the energy. Their commission should therefore be based on this amount alone, and not on taxes or grid access costs over which they have no influence.

- “Negotiable” pricing without a reference grid: A sales pitch that remains vague on prices, even after several follow-ups, indicates a lack of structure and seriousness.

The presence of two or more of these red flags should lead you to remove the broker from your selection.

Conclusion: Transparency as a Lever of Trust

The choice of an energy broker is a strategic decision that should not be taken lightly. Our 2025 investigation shows that while the market is moving towards greater professionalization, pricing opacity remains a major obstacle. For an SME or a large enterprise, the true cost of a broker can range from €3.60 to over €7 per MWh, a gap that justifies increased vigilance.

The key to a successful partnership lies in transparency. A trustworthy broker is one who communicates openly about their compensation model, details all fees in writing, and agrees to align their interests with those of their client. By adopting a structured approach—competitive tendering, demanding transparency, and informed negotiation—companies can turn the cost of brokerage into a profitable investment, with a return on investment that can be three to five times the initial outlay.

Resources and Tools

To support businesses in their process, EnergyProMag provides a set of practical resources.

- [Broker Selection Checklist (PDF)]: A step-by-step guide to evaluating and choosing the right partner.

- [Brokerage Cost Calculator]: An interactive tool to estimate the fair commission for your business profile.

Official Sources

- French Decree No. 2022-964 of July 1, 2022, on the transparency of information on electricity and natural gas supply offers

- Syndicat des Courtiers en Énergie (SCE) – French Energy Brokers Union

- Commission de Régulation de l’Énergie (CRE) – French Energy Regulatory Commission

- Médiateur National de l’Énergie – French National Energy Ombudsman

This article is the result of a three-month investigation conducted by the EnergyProMag editorial team, based on the analysis of 218 brokerage mandates and interviews with 47 brokers and 34 corporate clients across Europe. The fee ranges presented are averages observed in October 2025 and are provided for indicative purposes.