By the EnergyProMag.com Editorial Team

The European Union has initiated a profound transformation of its economy with an ambitious goal: to achieve a 55% reduction in its greenhouse gas emissions by 2030. This roadmap, known as the European Green Deal, and its regulatory arm, the “Fit for 55” package, are no longer just a statement of intent. The year 2026 marks a decisive turning point with the entry into force of several key measures that will directly impact the European economic fabric. While large corporations are actively preparing, many SMEs are still struggling to grasp the full extent of the upcoming changes. This article aims to decipher what is concretely changing for SMEs, assess the costs and risks, and, most importantly, present the opportunities to seize in order to turn this regulatory wave into a competitive advantage.

Table of Contents

Understanding the European Green Deal and the “Fit for 55” Package

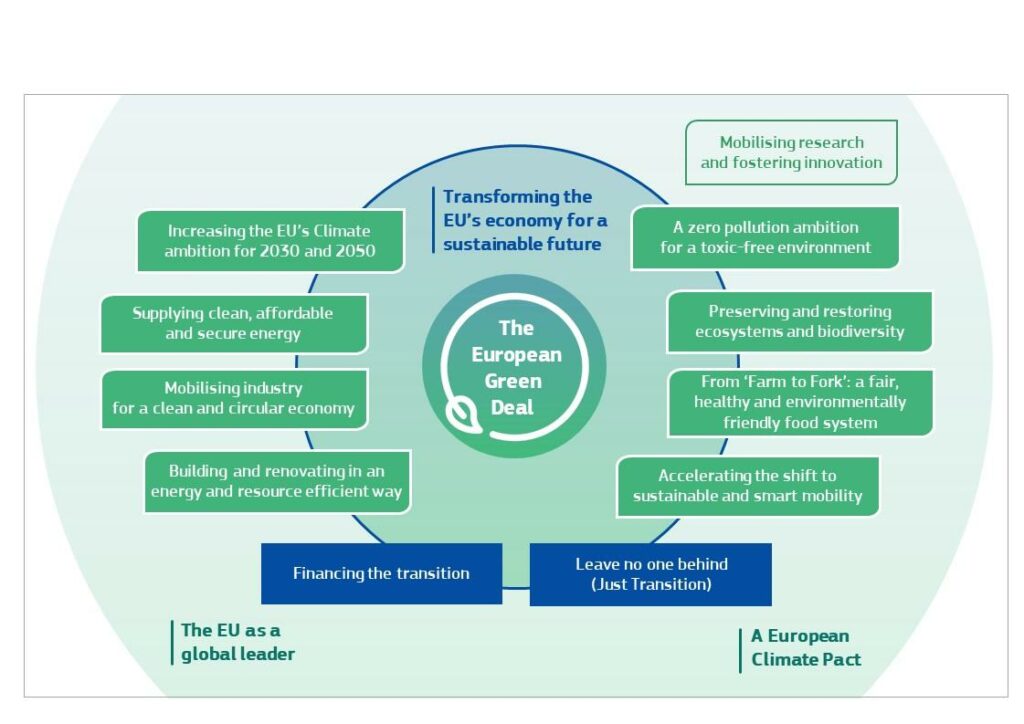

To navigate the energy transition, it is essential to master the vocabulary and mechanisms that govern it. The Green Deal and the “Fit for 55” package are two inseparable concepts that define the framework for EU climate action for the coming decade.

The Green Deal in a Nutshell

The European Green Deal is the European Union’s comprehensive strategy to achieve carbon neutrality by 2050. Launched in 2019, it is not just an environmental policy but a new economic growth model. With a budget of over €1 trillion for the decade, it aims to modernize the European economy by acting on several fundamental pillars:

- Energy: Promoting renewable energy and energy efficiency.

- Industry: Fostering a circular economy and clean production processes.

- Buildings: Accelerating the energy-efficient renovation of homes and offices.

- Transport: Developing sustainable mobility and reducing sector emissions.

The main pillars of the European Green Deal.

Fit for 55: The Green Deal’s Regulatory Arm

If the Green Deal sets the destination (carbon neutrality by 2050), the “Fit for 55” package is the concrete roadmap to get there. Presented in 2021, it is a set of thirteen interconnected legislative proposals aimed at achieving the crucial intermediate goal: a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels. It is this package that translates the ambitions of the Green Deal into legal obligations and market mechanisms for businesses.

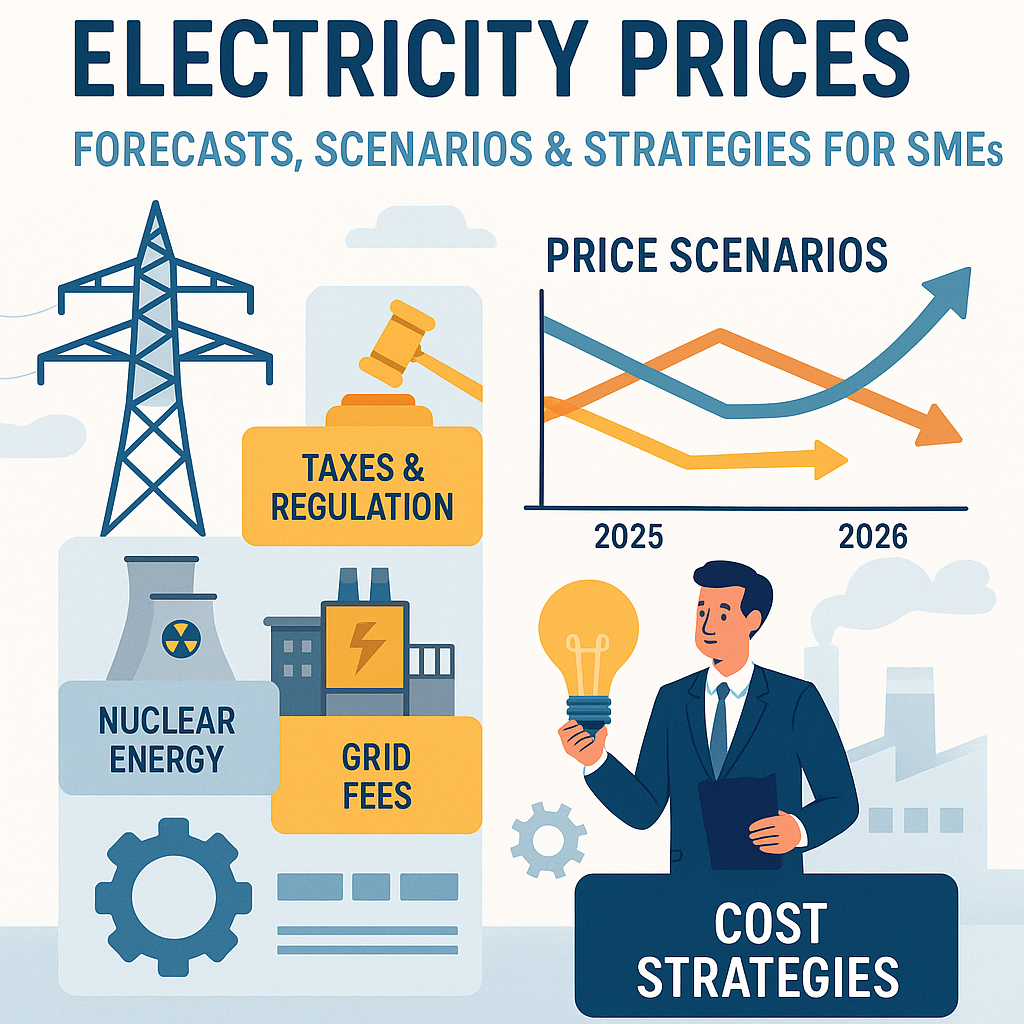

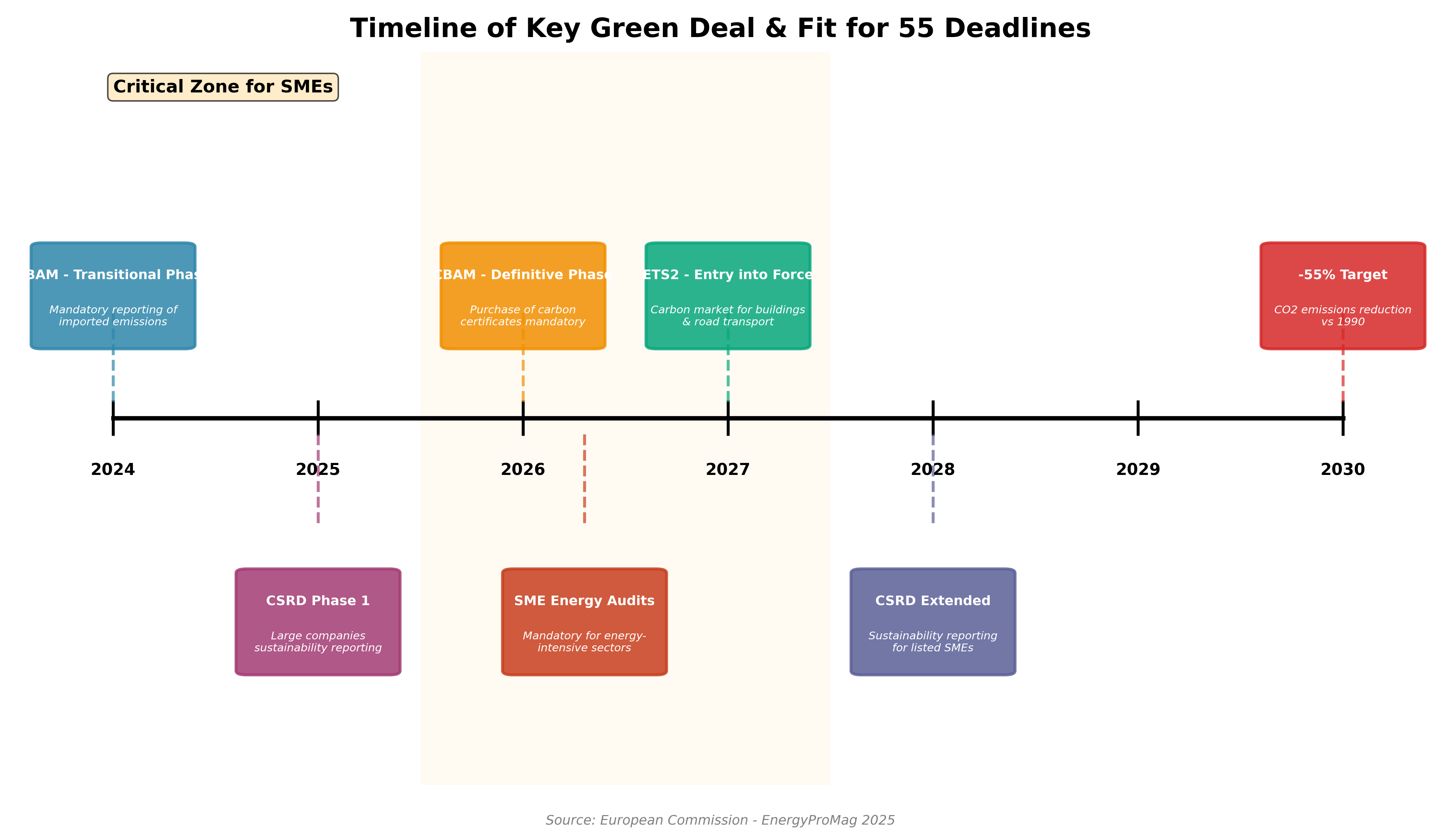

Why 2026 is a Pivotal Year

The year 2026 is not a randomly chosen date. It marks the transition from the planning phase to the implementation phase for several major texts of the “Fit for 55” package, with direct consequences for SMEs:

- CBAM Roll-out: The Carbon Border Adjustment Mechanism (CBAM) will enter its definitive phase, imposing a carbon cost on certain imports.

- Entry into force of ETS2: A new carbon market (EU ETS 2) will apply to building heating and road transport, impacting energy and logistics costs.

- New Energy Standards: Stricter energy performance requirements will be enforced for many commercial and industrial buildings.

Timeline of the main deadlines of the Green Deal and the “Fit for 55” package.

The 5 Key Measures That Will Impact European SMEs from 2026

Far from being abstract concepts, the regulations of the “Fit for 55” package will translate into very concrete changes in the daily life of businesses. Here are the five most important measures to anticipate.

1. CBAM: The Carbon Border Tax

The Carbon Border Adjustment Mechanism (CBAM) aims to prevent “carbon leakage,” i.e., the relocation of production to countries with less stringent environmental standards. From 2026, companies importing products into the EU in the sectors of steel, aluminum, cement, fertilizers, hydrogen, and electricity will have to purchase and surrender certificates corresponding to the carbon emissions of these products.

Concrete Impact: An SME in the metalworking industry that imports steel parts from a non-EU country will have to declare the associated emissions and pay a tax equivalent to the carbon price on the European market. A cost increase of 5% to 8% is estimated for these raw materials, directly impacting competitiveness if suppliers do not decarbonize their production.

2. ETS2: Extending the Carbon Market to Buildings and Transport

The EU Emissions Trading System (ETS) is the world’s largest carbon market. Until now, it has mainly concerned heavy industry and electricity production. The ETS2, which comes into force in 2027 (with reporting from 2026), extends this principle to building heating (gas, oil) and road transport fuel. Suppliers of these fuels will have to buy allowances, and this cost will inevitably be passed on to the final consumers, including SMEs.

Direct Consequence: Companies will see their heating and transport costs increase. Estimates predict an 8% to 15% rise in operating energy costs for these two areas, making the energy efficiency of buildings and vehicle fleets even more crucial.

3. The Energy Efficiency Directive (EED)

Revised as part of the “Fit for 55” package, this directive imposes a binding target of an 11.7% reduction in final energy consumption in the EU by 2030. To achieve this, Member States will have to implement stricter policies. One of the flagship measures will be the obligation for many SMEs, especially those in the most energy-intensive sectors, to conduct periodic energy audits. The “energy efficiency first” principle is becoming the norm.

4. The Green Taxonomy and Sustainable Finance

The EU Taxonomy is a classification of economic activities considered “sustainable.” Gradually, banks, insurers, and investors will be required to publish the “green” share of their portfolios. Consequently, they will increasingly integrate environmental criteria into their financing decisions.

Opportunity and Risk: An SME without a clear decarbonization strategy could be offered loans at higher rates or even be denied financing. Conversely, an SME committed to a transition process, with proven green investments, will benefit from more favorable financing conditions and easier access to capital.

5. New Reporting Standards (CSRD)

The Corporate Sustainability Reporting Directive (CSRD) already requires large companies (and soon listed SMEs) to publish detailed information on their environmental and social impacts. The cascade effect is inevitable: to calculate their own carbon footprint (especially Scope 3, which includes value chain emissions), these large groups will require precise data from their suppliers and subcontractors, including SMEs.

Indirect but Powerful Impact: The energy and carbon performance of an SME will become an essential selection criterion to remain in the supply chain of large accounts. Compliance is no longer an option, but a commercial prerequisite.

Comparative Table: The 5 Key Measures of Fit for 55

| Measure | Entry into Force | Sectors Concerned | SME Impact | Urgency Level |

|---|---|---|---|---|

| CBAM (Carbon Border Tax) | 2026 (definitive phase) | Importers of steel, aluminum, cement, fertilizers, electricity | Increased raw material costs (+5-8%) | ⚠️⚠️⚠️ High |

| ETS2 (Extended Carbon Market) | 2027 | All sectors (building heating + road transport) | Increased energy & logistics costs (+8-15%) | ⚠️⚠️⚠️ Very High |

| Energy Efficiency Directive | 2026-2030 | Energy-intensive SMEs | Mandatory audits, reduction targets | ⚠️⚠️ Medium |

| Green Taxonomy | Ongoing | All companies seeking financing | Access to credit linked to ESG performance | ⚠️⚠️ Medium |

| CSRD (Sustainability Reporting) | 2025-2028 | Large companies + listed SMEs + suppliers | Obligation to provide carbon data | ⚠️⚠️⚠️ High |

SMEs are at the heart of the European energy transition.

The Concrete Impacts for SMEs: Costs, Risks, and Opportunities

These new regulations are not without consequences. They create a new economic environment where carbon performance becomes a competitiveness factor as important as labor costs or product quality. For SMEs, the impacts are threefold: costs, risks, and, above all, opportunities.

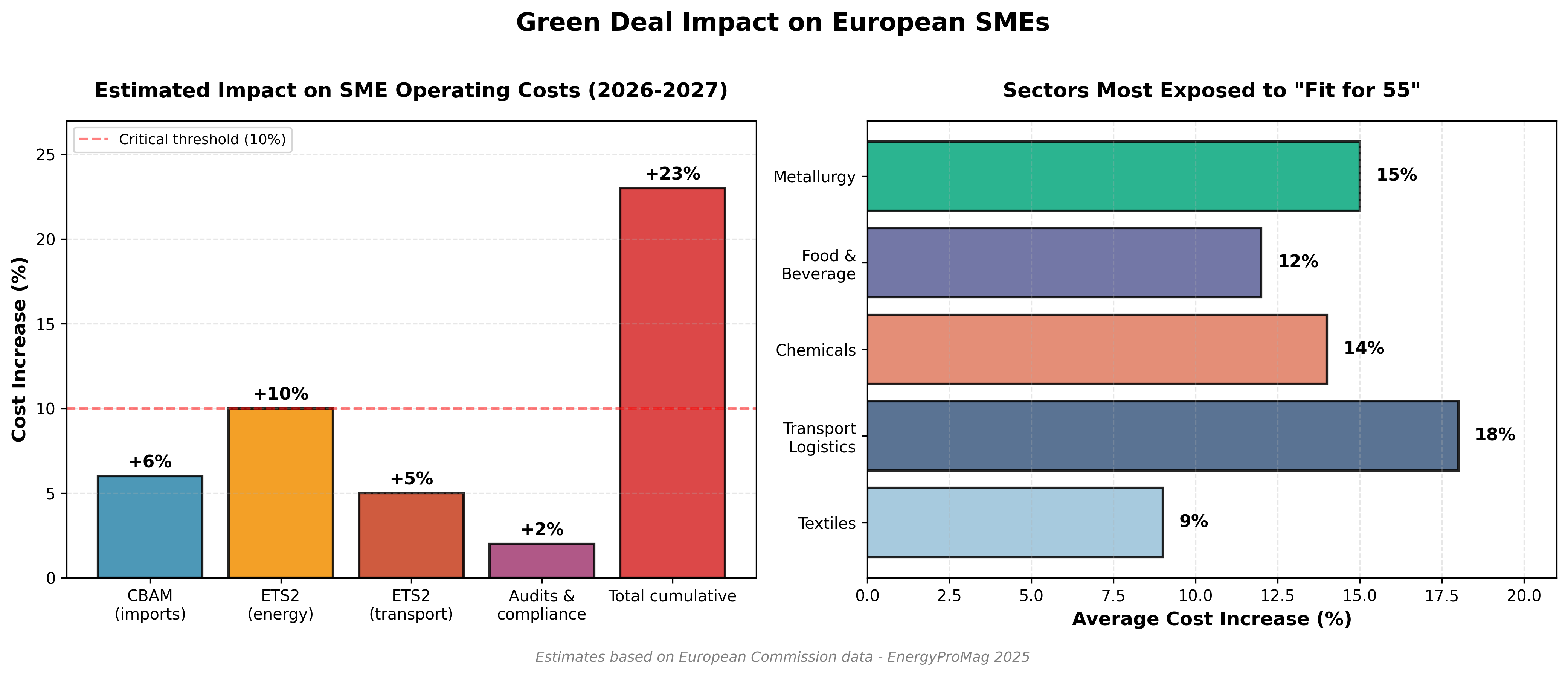

Rising Operational Costs

The first and most direct impact is an increase in costs. The cumulative effect of CBAM on imported raw materials and ETS2 on energy and transport will be felt. Projections estimate an average increase in operational costs of 5% to 12% for the most exposed industrial SMEs. This pressure on margins forces companies to rethink their cost structure and integrate the price of carbon as a strategic variable.

Estimated financial impacts of the Green Deal on SMEs by measure and by sector.

Non-Compliance Risks

Ignoring these new rules is not a viable option. The risks associated with non-compliance are multiple:

- Financial Penalties: Fines are planned for companies that do not comply with their reporting obligations (CBAM, CSRD).

- Market Exclusion: More and more public and private tenders are integrating environmental criteria. From 2026, it will be common to see requirements for a carbon footprint or proof of an energy audit to be eligible to bid.

- Loss of Strategic Clients: Large groups, subject to the CSRD, will evaluate their suppliers on their carbon performance. An SME that cannot provide reliable data risks being delisted.

New Business Opportunities

However, viewing the Green Deal solely as a source of constraints would be a strategic mistake. It also opens the door to new opportunities for proactive SMEs:

- Sustainable Reduction of the Energy Bill: Every kWh saved through energy efficiency is a net gain, all the more important as energy prices rise.

- Competitive Advantage: A low-carbon SME becomes a supplier of choice in a value chain that seeks to decarbonize. It is a powerful differentiating argument.

- Access to Privileged Financing and Markets: Virtuous companies will benefit from priority access to European grants (such as the Innovation Fund or Horizon Europe) and attractive financing conditions from banks.

Table: Estimated Financial Impacts by SME Type

| SME Type | Annual Revenue | Energy Consumption | CBAM Impact | ETS2 Impact | Total Estimated Impact | Annual Additional Cost |

|---|---|---|---|---|---|---|

| Industrial SME (Metallurgy) | €15M | 800 MWh elec + 1,200 MWh gas | +€45k | +€65k | +€110k/year | +0.7% of Revenue |

| Food & Beverage SME | €10M | 1,200 MWh elec + 600 MWh gas | +€15k | +€50k | +€65k/year | +0.65% of Revenue |

| Transport & Logistics SME | €8M | 300 MWh elec + 2,000 MWh fuel | +€5k | +€90k | +€95k/year | +1.2% of Revenue |

| Chemical SME | €20M | 1,500 MWh elec + 2,500 MWh gas | +€80k | +€110k | +€190k/year | +0.95% of Revenue |

| Textile SME | €5M | 400 MWh elec + 300 MWh gas | +€20k | +€25k | +€45k/year | +0.9% of Revenue |

Assumptions: CO2 price at €85/t in 2027, 100% ETS2 pass-through rate, CBAM on 30% of purchases for affected sectors.

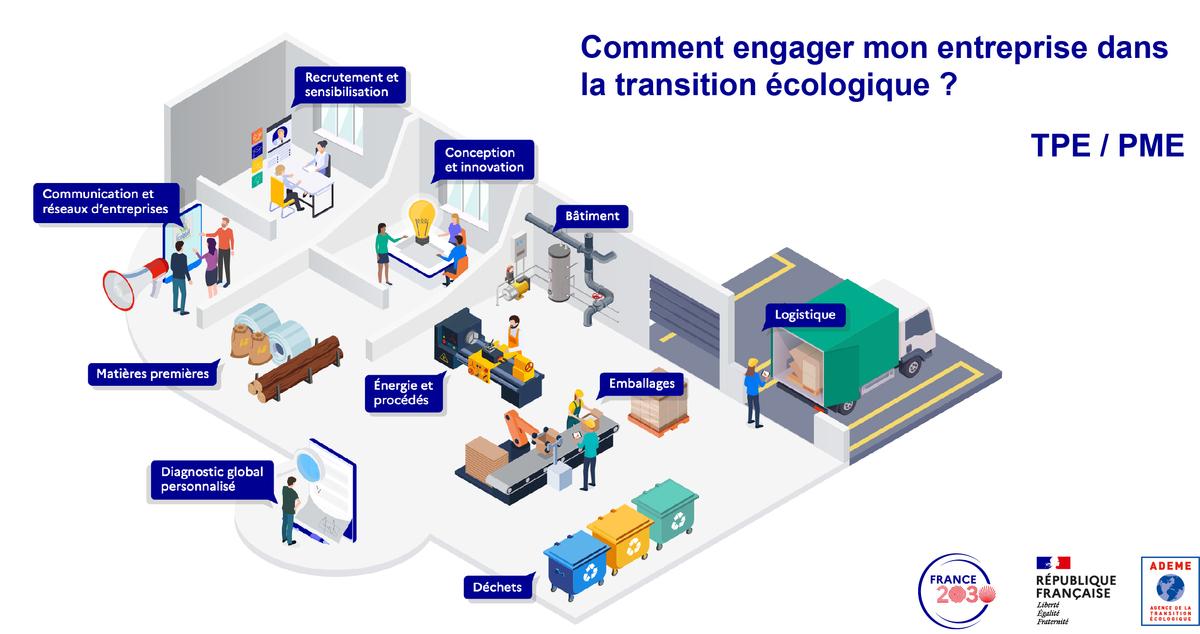

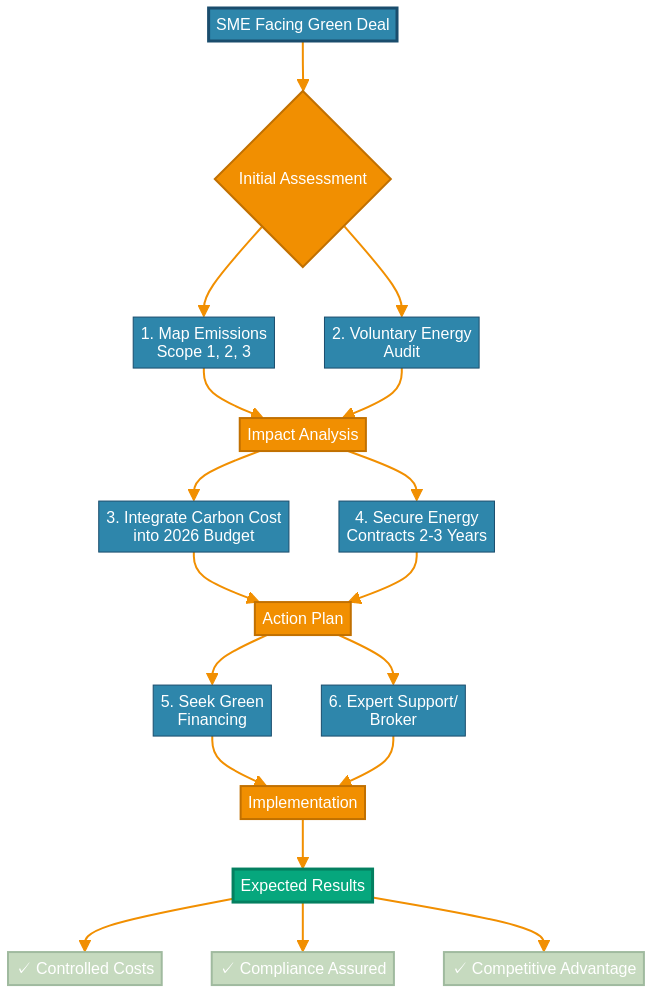

How to Anticipate Today: 6 Priority Actions

The 2026 deadline may seem distant, but preparation must start now. Waiting until the last minute means risking being subjected to the regulations instead of using them to your advantage. Here is a 6-action roadmap for any SME wishing to take the lead.

1. Map Your Emissions and Consumption

The first step is to know where you stand. It is essential to carry out a simplified carbon footprint assessment to identify the main sources of emissions: Scope 1 (direct emissions, such as gas from boilers), Scope 2 (indirect emissions related to electricity), and, if possible, the most significant items of Scope 3 (transport, purchases, etc.).

2. Conduct an Energy Audit Before It Becomes Mandatory

Even if your company is not yet legally required to do so, conducting a voluntary energy audit is one of the most profitable investments. It provides a clear vision of energy saving potentials and is a prerequisite for many grant applications.

3. Integrate the Cost of Carbon into Budget Forecasts

From 2025, budgets for 2026 and beyond must include a line for the “cost of carbon.” Based on a forecast of €80 to €100 per ton of CO2, an SME can simulate the impact of ETS2 on its transport and heating costs and thus anticipate financing needs.

4. Secure Your Energy Contracts for 2-3 Years

Faced with the expected price increase with the introduction of ETS2, it is strategic to secure your electricity and gas supply contracts for a period of 2 to 3 years as soon as possible. This helps to smooth the impact of the new tax and provides better budget visibility.

5. Explore Available Green Financing

Numerous grant programs exist at the European and national levels to co-finance energy efficiency and decarbonization projects. Schemes like the Innovation Fund, the LIFE program, or national decarbonization funds can cover up to 60% of a project’s costs.

6. Get Expert Support

Navigating the complexity of these regulations and opportunities can be difficult. Using the services of an energy broker or a specialized consulting firm saves time, secures decisions, and maximizes the financial and strategic benefits of the transition.

A structured process for anticipating the Green Deal for European SMEs.

Table: Main Grants and Financing Available for SMEs

| Program | Body | Aid Type | Amount / Rate | Eligibility | Covered Areas |

|---|---|---|---|---|---|

| Innovation Fund | European Commission | Grant | Up to 60% of project | Innovative decarbonization projects | Low-carbon tech, renewables |

| LIFE Programme | European Commission | Grant + Loan | 55-75% depending on strand | SMEs with environmental projects | Energy efficiency, circular economy |

| Horizon Europe | European Commission | R&D Grant | Varies by call | Consortia with R&D partners | Green tech innovation |

| National Decarbonization Funds | National Agencies | Grant | 30-50% | Industrial SMEs | Electrification, cogeneration, low-carbon processes |

| Energy Savings Schemes | Energy Suppliers | Direct premium | 20-40% of project | Standardized works | Insulation, heat recovery, efficient motors |

| Green Bank Loans | Commercial Banks | Reduced rate | -0.5% to -1.5% vs standard rate | SMEs with ESG strategy | Certified green investments |

Table: Preparation Checklist for SMEs

| Priority Action | Recommended Deadline | Estimated Cost | ROI / Benefit | Difficulty |

|---|---|---|---|---|

| Simplified carbon footprint (Scope 1-2) | Before end of 2025 | €2k – €5k | Visibility on impacts + grant eligibility | ⭐ Easy |

| Full energy audit | Before mid-2026 | €5k – €15k (50% subsidized) | Identification of 10-20% savings potential | ⭐⭐ Medium |

| Secure 2-3 year fixed energy contract | ASAP | Free (via broker) | Protection against ETS2 price hike | ⭐ Easy |

| Integrate carbon cost into budget forecasts | Before 2026 budget | Free | Financial anticipation | ⭐ Easy |

| Identify and apply for grants | Q1 2025 | Internal time or consultant | 30-60% project financing | ⭐⭐⭐ Difficult |

| Train management team on Green Deal | Q4 2024 / Q1 2025 | €1k – €3k | Corporate culture + informed decision-making | ⭐ Easy |

| Implement energy KPI tracking | Before 2026 | €3k – €10k (software + sensors) | Continuous monitoring + deviation detection | ⭐⭐ Medium |

Case Study: An Industrial SME Facing “Fit for 55”

Let’s take the real case of a Belgian SME in the metallurgy sector (280 employees). A prospective analysis showed that the combined effect of CBAM on its steel imports and ETS2 on its gas and oil consumption would lead to a 7% increase in its operational costs by 2027.

By anticipating from 2024, the company implemented an action plan that fully offset this impact in just 18 months:

- Energy audit subsidized at 50% by the region.

- Switch from a variable to a fixed-price energy contract for 3 years, negotiated before the price hike.

- Installation of 800 kWp of rooftop solar panels, financing 40% of its consumption and reducing its grid dependency.

Result: By 2026, despite the new regulatory context, the company had not only stabilized its costs but had also reduced its CO2 emissions by 12% and its net energy bill by 4%, thus strengthening its market position.

FAQ: The Green Deal and Your SME

1. What is the European Green Deal?

It is the EU’s comprehensive strategy to achieve carbon neutrality by 2050, by transforming its economy around energy, industry, buildings, and transport.

2. What does the “Fit for 55” package contain?

It is a set of 13 laws that translate the ambition of the Green Deal into concrete rules to achieve a -55% reduction in CO2 emissions by 2030.

3. Which sectors are affected by CBAM (carbon tax)?

Initially: steel, aluminum, cement, fertilizers, hydrogen, and electricity imported from non-EU countries.

4. When will the ETS2 carbon market apply?

It will come into force in 2027, but monitoring and reporting obligations will begin in 2026 for building heating and road transport.

5. Are SMEs directly affected?

Yes, increasingly so. Either directly through obligations (audits, reporting) or indirectly through rising costs (ETS2) and the demands of their customers (CSRD).

6. What are the main grants available for SMEs?

Grants vary by country and region but often include aid for energy audits, investment in energy efficiency (via mechanisms like energy savings schemes), and decarbonization (national and European funds).

7. How can I easily calculate my carbon footprint?

Start with your energy bills (electricity, gas, oil) and fuel bills (vehicle fleet). This is the basis of Scope 1 and 2. Online tools can help you for a first estimate.

8. What energy purchasing strategy should be adopted before 2026?

It is strongly recommended to seek to secure part or all of your consumption on fixed-price contracts of 2 to 3 years to avoid the volatility expected with ETS2.

9. What are the benefits of investing in energy efficiency?

A triple benefit: reduction of the energy bill, decreased dependence on volatile markets, and improvement of your brand image with customers and partners.

10. What are the concrete obligations for an SME in 2026?

It depends on your sector and size, but new obligations may include: import declarations (CBAM), energy reporting for your large customers (CSRD), and potentially a mandatory energy audit.

Conclusion: Turning Obligation into Strategy

The Green Deal and the “Fit for 55” package are not just another layer of environmental regulation. They are redefining the rules of competitiveness in Europe. For SMEs, waiting is no longer an option. To anticipate is to give oneself the means to control costs, manage risks, and position oneself as a responsible and resilient player. The energy transition, although complex, is above all a formidable lever for modernization and differentiation. The companies that understand this today will be the leaders of tomorrow.

About EnergyProMag.com

EnergyProMag.com is the leading magazine for energy professionals and manufacturers seeking energy optimization.